Fucking euphemisms for ‘corporate greed’.

So for like a dozen years between 2008 to 2020 corporations weren’t greedy?

Corporations finding a new way to be greedy does not mean they were not greedy in the past as well.

But asserting that the new inflation is a result of corporate greed does imply that the corporate greed is a new factor. It doesn’t make any sense

My dude, corporations were putting in their earnings reports for the COVID years that they were having record profits because they were using COVID-based supply disruptions to increase their prices. Even a basic knowledge of economics would lead one to understand that if supply for a good becomes limited, demand stays the same, and profits go up, it could only be because the price of that good has significantly increased as well.

Profits go up per unit, but not necessarily the total amount since you’re moving fewer units

Except corporations were posting record profits. So both profit per unit and overall profitability were increased.

They took advantage of COVID to fleece the public.

If you’ve been paying attention you would have seen that profit margins were going up as well

For some companies, sure.

Intel and AMD, for example, already sold so many computers during the pandemic their profits are down now

No it implies there was a factor restraining that greed before and it’s been removed.

No, just a new type.

How is it a new type? What’s new?

Getting away with price gouging is new.

So the greed is constant, but the market let companies raise prices.

The greed isn’t the new part. The new part is lack of competition after thousands of small businesses got forcibly shut down in 2020.

That’s what I’m saying, pandemic, shutdowns, stimulus, etc. is the new thing

The Socratic method requires someone else who’s leaning in. When people are leaning out you just gotta come right out and say the thing.

during those years the corporate/investors focus was on market share growth, so they purposely went for low prices or free when possible. when the money spigot turned off things switched from growth to profit/dividend and consumers are stuck.

Yes, the low interest rates we had for years meant basically free money for all these companies in addition to the low car loan and mortgage rates that the rest of us benefitted from. Interest rates being low was a tool used to pull us out of the recession but nobody had the balls to raise them back when things turned around because you can’t win elections by forcing people to take their medicine.

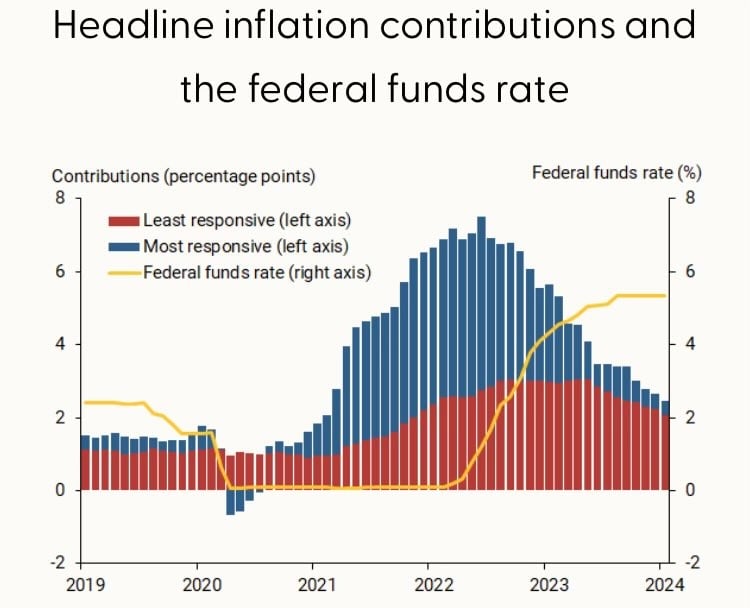

It’s the opposite, inflation actually decreased after the rate hikes.

which rate hikes/time period are you talking about?

We had the most inflation in 2022, then the Fed increased rates and the inflation went lower as the rates went higher

You can’t just throw an image up. You have to source it or we’re going to assume you made it in MSPaint. But you’re already showing signs of not understanding what inflation is. It is not some stand alone year by year metric. It’s a velocity measurement. Like your car’s speedometer. You drove X number of miles in Y time. Instead here it’s you rose X points in 1 year. The previous points do not go away. The wage increases from year 4 do not magically erase inflation from years 1-3, unless they beat year 4 inflation by the the sum of inflation from years 1-3.

Source:

https://twitter.com/ah_shapiro/status/1777696160691704213

You’re the one who doesn’t know that inflation is curbed by interest rates, since you proposed interest rates increase inflation

In fact, higher interest rates decrease inflation

Greed is just one part of the equation of higher prices. You also need opportunity. If prices ramped up so rapidly without a plausible excuse, then it would lead to an investigation. Hell, the egg producers took their excuse of bird flu too far and jacked up prices about 6x, which was so ridiculous that it did lead to the threat of an investigation and that alone magically got the price down to “only” about 2x.

Which part of the equation is it?

Like how much greed gives you 1% higher prices? How do you measure greed?

It doesn’t map so simply. Greed will try to push prices up as high as possible, but what’s possible depends on other factors. People can understand how a global pandemic causing supply issues would lead to higher prices, but greed took full advantage of that understanding and pushed it far beyond limits.

It didn’t push beyond limits, greed pushes the price exactly up to the limit people will pay.

That’s like claiming that no one gets scammed because they were willing to participate.

Usually a scammer doesn’t uphold his end of the contract. They promised you something, but you didn’t get it.

That’s not the case here

It’s societal greed.

All of the people criticizing those maximizing profit would do the same in their position.

You have a point in that corporations align closely with human greed. However, corporations are anti-social and amoral unlike human beings. We need them to serve humanity and not the other way round. They’re currently taking too much too quickly.

no, I would not apply for a job at McKinsey.

And the problem is that even if it goes back to 2%, it’s still fresh in everyone’s memory that CPI was 17.5% lower (1$ March 2020 = 1.21$ March 2024) and it’s not very fair to the average person that the number they hear only compares to the previous year when it’s not what they’re feeling in their wallet as there’s never been deflation.

What I’m saying is, we know when the high inflation period started, media should report both the year-on-year change and inflation compared to a specific month before the last major economy influencing event, that would help people understand the information presented to them and why it feels like prices are still up much more than 3%.

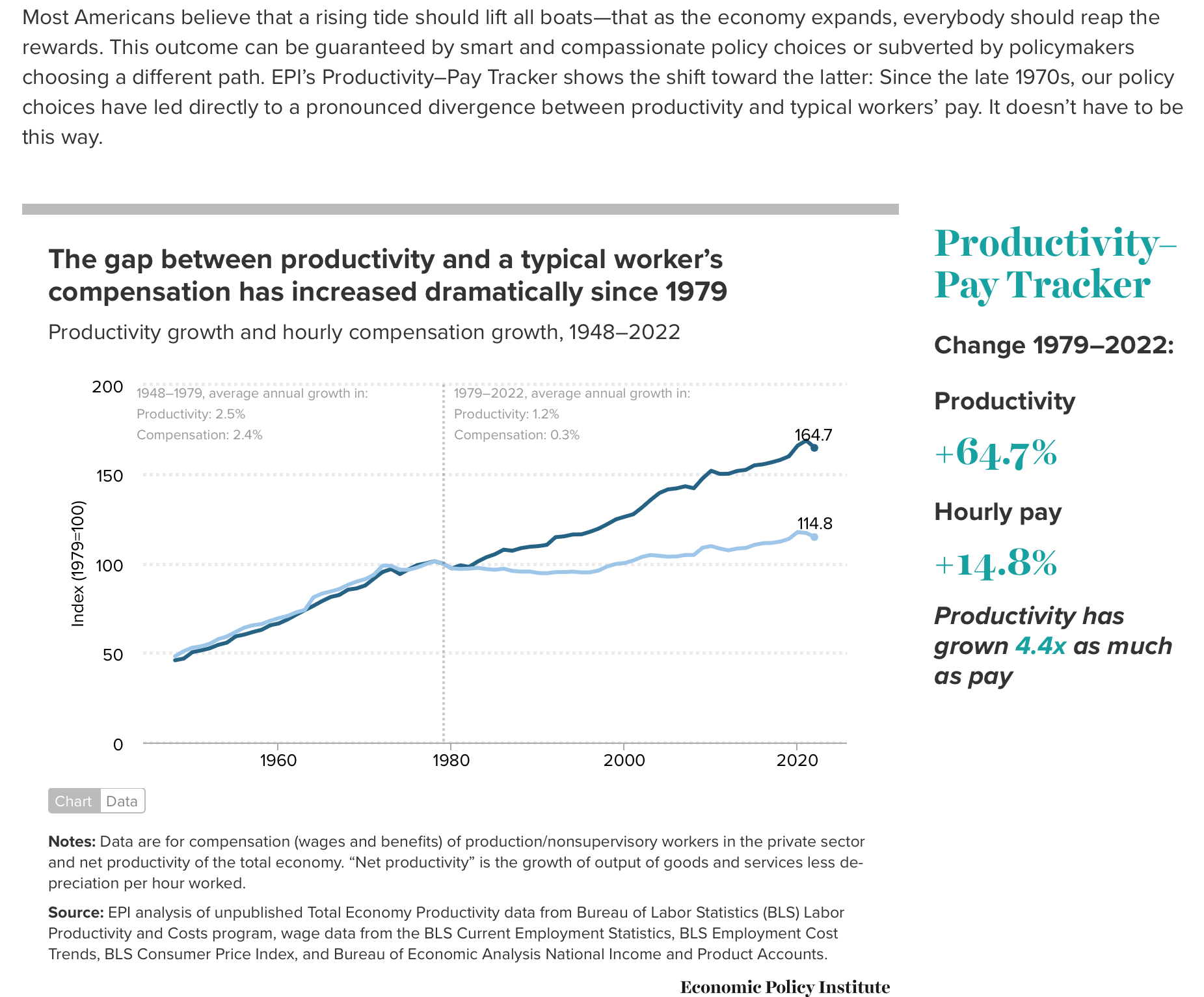

The media reports it that way because the guys who run the economy report it that way. We need an inflation tracker website that tracks the divergence of wages from inflation like the conservatives have for the national debt.

inflation would not be a problem if wages went up as well.

Wages are always and forever blamed on inflation, despite lagging inflation year after year after year.

And then you think about it and you’re like “If inflation goes up X% and all wages need to go up the same amount in order for people to keep up, why is inflation necessary again?”

There’s an economic argument for steady inflation as a counterweight against compound interest and debt.

Inflation creates an economic incentive for productive investment. I’d rather own a $20 machine that generates $1/year of new valuable goods/services than a $20 bill in a vault, because the goods/services will inflate in value while the cash will not. And if I don’t have $20, I’ll be willing to borrow it if the value of the debt declines over time while the value of my annual production rises.

When wages match inflation rates and surplus cash can be productively invested, each new participant in the economy has an opportunity to grow their personal fortunes over time.

However, when wages lag inflation, only the early adopters get to see the benefits of new productivity. Old money compounds faster than new wage earn investment enters the pool. And eventually you get a Berkshire Hathaway / Goldman Sachs / Blackrock / Citadel style superfund that owns a significant percentage of virtually everything.

The same thing happens in deflation. People with access to cheap credit or liquid currency (banks, mostly) can horde capital while wages contract. And then, again, you end up with an economy in which a handful of feudal aristocrats hold the titles on all the properties.

But when wages grow faster than inflation, you see the reverse. Earners can buy into property at a steady discount, while investment of new properties promise higher yields than simply sitting on old capital stock indefinitely.

There’s an economist named Thomas Piketty who breaks it down thoroughly in Capitalism in the 21st Century, detailing why you want the economic growth of your national economy (G) to exceed the rate of return on investment (R) if you care about reducing overall economic inequality.

That’s fine and all, and I wish it were so. We just live in an economic reality that has been steadily increasing the inequality with consequences such as unaffordable housing, healthcare, and education.

Inflating the debt away is advantageous only if the TCO keeps up. In this case the wealthy get the lion’s share of inflationary increases while many people only see modest cost of living offsets that for two years fell behind inflation. We seldom see years where employers give a cost of living adjustment above the current inflationary rate beyond the current year index, to make up for prior years where they didn’t.

E.g. I see a job posting from 2007 that advertised 65k/year, in the same company with the same role they currently only compensate that same role at about 73k. $65k from 2007 equates to approximately $97k in today’s money. If things were truly equitable and commensurate, and I realize this is an isolated data sample, but it appears to be a common trend across the country.

For the numbers, that’s $24k of income that would be really great to have today.

E.g. I see a job posting from 2007 that advertised 65k/year, in the same company with the same role they currently only compensate that same role at about 73k. $65k from 2007 equates to approximately $97k in today’s money. If things were truly equitable and commensurate, and I realize this is an isolated data sample, but it appears to be a common trend across the country.

I absolutely agree. And I’m willing to bet that the profit at that same firm has only grown over time. So here we have a classic case in which profit margins have outpaced the real volume growth at this firm, making it less efficient and more expensive to operate as a result.

For the numbers, that’s $24k of income that would be really great to have today.

Oh sure. Numbers get even worse when you consider how that $24k of income is buying even less housing, health care, and utilities than it did in 2007, and for all the same reasons.

As profit margin eclipses real growth, the real economy is subsumed by fictitious assets.

why is inflation necessary again?

stock market go brrr

If a company makes less profit than last quarter, no matter how many billions in profit that actually comes out to or how satisfied the customers are with the company’s products, investors will be sad and the line will go down. If a company makes more profit than last quarter, the line goes up regardless of if that growth is actually sustainable long term because that’s not our problem right now. All that matters is we can tell investors we had record profits this quarter, the executives get to take home their million dollar bonuses, and the line doesn’t go down until after those execs leave for even greener pastures.

So, a company can’t just be good at what it does at the scale that it does it, it must grow constantly like a cancerous tumor in order to stay attractive to investors. When people are flush with cash you squeeze it out of them as fast as you possibly can because, again, the future doesn’t matter right now and anyways they’ll just give it to someone else if you don’t take it first. Sell products that don’t last very long so the customer keeps coming back. Raise prices and cut staff when times are anything less than stellar but never under any circumstances lower prices or give workers more than the lowest amount it takes to keep them working, because that means less profit which means the line will go down which means the execs don’t get their bonuses and that is a fate worse than death.

That’s the thing with greed: they find many names for it to distract from them personally. East the rich. But get on with it already.

Year 1 inflation: “We wanted to make sure your raise kept up.” Year 2: “We’re a fledgling company!”

It wouldn’t be a problem if the government wasn’t addicted to printing money like a dope fiend.

Found the Diapers Over Dems, corporations are people, and school shootings aren’t a problem dude.

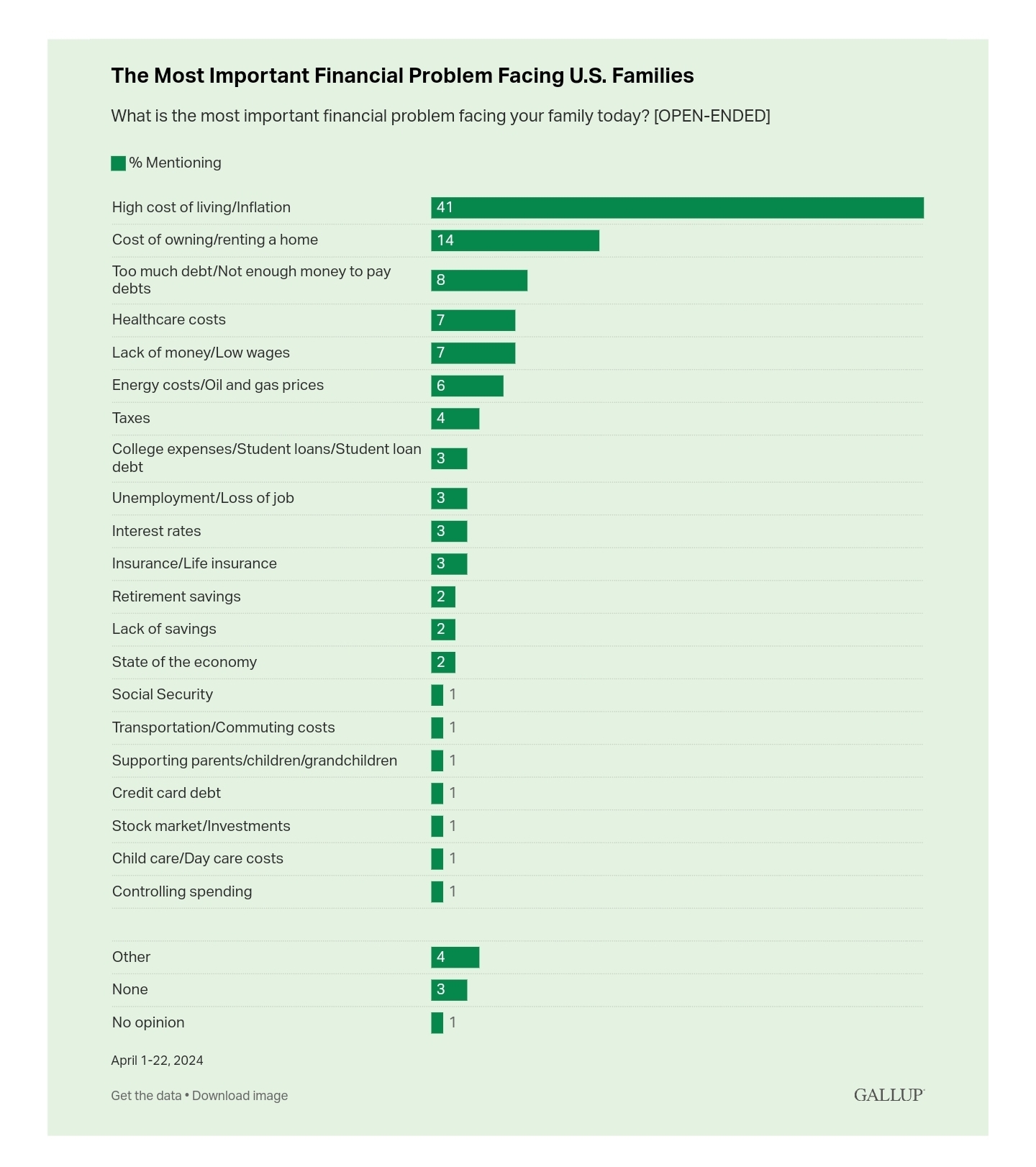

“High cost of living/Inflation” so not simply “Inflation”

Also, when would that ever not be the top category? “Things cost too much” seems like kind of a supercategory covering most of the others. Maybe “lack of money” could compete.

The top is less important than the ratio. The top 2 answers are basically stuff costs too much. Over half the people are claiming that is their biggest problem. If times were better, it still might be the top, but it shouldn’t be the majority. Debt concerns, and retirement would take a bigger chunk.

rent gauging. wildly insane property values. gas price gauging. it’s not just food prices, tho that sucks too

I think I understand what you are saying (about the title, ya?), buy are they not connected somehow?

Cost of living might be always high, not increasing much every year

Inflation is the rate of increase

Thanks.

Actually I’m really confused with how that list is done.

Retailers jacked up prices and squeezed consumers. They might have just blinked I hope consumers still don’t bat many eyelashes because capitalism best practices def looked to squeeze consumers. Record profits, stock markets riding high, rich got even richer, meanwhile ever more people struggle up and down ‘main street’.

That’s okay, because eventually we’re just going to automate away the need for all those struggling people. And then we won’t care if they participate in the economy anymore. We can… ahem… zero them out.

We’re witnessing this process in areas like Yemen, Palestine, and Kashmir as we speak. If you get under the hood of MBS’s 30 year plan for Saudi Arabia, you’ll notice a sharp drop in the expected demand for labor. This, from a man who doesn’t bat an eye at walking a guy into an embassy and dismembering him with a chainsaw.

Go ask Andreessen Horowitz or Peter Thiel or Bill Gates what they’d like to see happen to the human population going into the 22nd century, and you’ll get similar speculative responses.

you would think money would be the primary financial issue.

last i checked nobody likes it. Weird how we still pretend like it’s other shit.

They must have a lot of savings

You realize that inflation not only tends to exceed raises, raises go into effect on a typically yearly schedule while inflation does not, yes?

Do I look like I know basic economics?

No.

That’s not the news you want it to be. First of all I’ve seen this breathlessly reported several times with bad data. The revised data comes out and repeatedly gives inflation the win. Second, even if we did come out as a wash this year, there’s still a 10 percent gap just between wages and Inflation in just the last few years. And a ~130 point gap since the mid 1970’s. So put the party hats down, we still have work to do.

Well, it is great that we have the good people of Lemmy to correct the economists from the Bureau of Labor Statistics and the banks then. Wouldn’t want fake news.

You didn’t read my comment then. It’s the journalists reading the data they want rather than the actual data.