Summary

Tesla board members and executives have sold over $100 million in stock since early February as the company’s shares decline.

Board member James Murdoch sold $13 million in stock on March 10, coinciding with Tesla’s worst single-day drop in five years.

Kimbal Musk sold $27 million in shares last month, and board chair Robyn Denholm offloaded over $75 million through a predetermined plan.

The sell-offs come as Tesla’s stock has fallen nearly 50% since December.

Live by the meme, die by the meme

Next up: Mango Mussolini says Tesla is too big to fail and government-finances it.

Capitalism for thee, but Communism for me.

“I have ran my company into the ground with my incompetence and hate mongering, I am a literal nazi, doing the salutes and everything … everyone hates me, but the business is too big to fail … bailouts please!”

Mango Mussolini

You cheeky devil. This made me lose my shit.

Best outcome when you’re Lemmying on the shitter

The wise ones sold as much stock as possible.

Tesla stock is most likely to drop way more. Global sales being down about 50% for February, demands the stock must fall even more.

Even corrupt government contracts can’t compensate for the loss of global marketshare every Musk nut was so convinced would increase to a degree where Tesla would be bigger than all other car companies combined.The stock price was always ridiculously high, and it still is.

The P/E ratio is off the charts. Things will get really interesting after the Q1 earnings call on April 29th.

https://www.financecharts.com/compare/TSLA,TM/value/pe-ratio

So uh… Toyota’s PE is almost 8, a bit down from its historical average of about 9 or 10.

Tesla’s is currently about 115.

Down almost 50% from its highs around 200 during Jan 2025.

If Tesla’s actual $$$ stock/share value dropped down to … lets say a PE of 10… that would be… well ok it is currently still dropping rather rapidly, but lets say rightnnow its $225 per share.

If Tesla ‘corrected’ to a PE of 10, that’s a share value of about $19.57.

About a 91% drop from where it is right now…

… which would wipe out around $700 billion of market cap.

These are ballpark figures based on a hypothetical scenario, this is not financial advice, but yeah, that is a way of looking at how overvalued Tesla is (or could be).

EDIT: Musk himself apparently owns about 410 million Tesla shares, as of Feb 2025.

https://www.investopedia.com/articles/insights/052616/top-4-tesla-shareholders-tsla.asp

So… a 91% reduction of 410m shares * $225 per share…

That would be a personal loss for Musk of about $82 billion, from this exact moment.

That’d put his net worth at about $273b, based on him having a net worth of $355b as of Feb 2025… but his net worth may already be significantly less than $355b, because Tesla has dropped a lot between the date of the source I’ve found for his net worth, and right now.

EDIT 2

https://www.forbes.com/profile/elon-musk/?list=rtb%2F&sh=7123ba5d7999

Uh wow yeah, ok, between Feb 28 2025 and Mar 18 2025, he’s already lost about $34 billion… and is currently at $321 billion.

So… if you take $82 b out of $321, then he’s down to around $240 ish.

Sadly… he would be the richest person in the world, even after that, he’d have to get below $210b ish to sink to #2 under Bezos, below about $200b to be #3, also under Zucky boy.

And all this is without even taking into account the fall of the Earnings side of the P/E.

If Tesla sales keep falling that “correct” P/E or 10 won’t be $19.57, it will be a lower number that keeps on falling along with the fall in sales because less sales means less earnings.

Even better: like all automakers Tesla has a lot of fixed capital costs which can’t be easily shrinked (factories, equipment) so the fall in sales might actually push them below profitability since they will only be able to reduce costs in the short and mid term up to a point (it take time to sell a factory and the equipment in it)

If the company becomes unprofitable, it will need money from outside to keep going, and in an environment of quickly falling share prices that money is not going to come from outside investors and getting it from lenders using Tesla’s own stock as collateral will be very difficult if not impossible.

A fast enough fall in sales right alongside a steep fall in stock price could bankrupt Tesla.

If the company becomes unprofitable, it will need money from outside to keep going, and in an environment of quickly falling share prices […]

Oh, oh, I know this one! The answer is “a government bailout!”

Correct!

My hypothetical is greatly oversimplified… in a way that is arguably optimistic.

All very good other points to add… I’ve got a slowly healing but fucked up wrist/hand, so I can only type so much.

I wouldn’t be surprised if Tesla chooses to cook the books.

It will be very strange if numbers aren’t in red.They might pull an Oracle and stop reporting certain numbers and aggregate them with something else. Like when oracle stopped reporting cloud revenue as it’s own line item.

Oh man, that would be so illegal! The SEC would surely step in to investigate that, right?

Right?

…right…?

We have looked at several book covers, and everything seems fine.

They are already cooking the books: https://motorillustrated.com/suspicious-tesla-sales-surge-triggers-canadian-government-investigation/149947/

Yes that’s a very weird story, I’m looking forward to hear what the investigation reveals.

Spoiler alert: it will only reveal that the US no longer honors extradition treaties.

Can you imagine what would happen if fElon visited Canada and the arrested him?

I’d like to imagine the good parts (Canada holding him accountable), and not the insane fascist parts (whatever stupid or dangerous threats our Cheeto Mussolini would make).

For someone who knows nothing about stocks, what is a P/E ratio?

The price the market is willing to pay for one share of stock vs the amount of profit the company is making per share.

A P/E of 90 means someone is willing to pay $90 for a share of a company that is netting $1 of profit for each outstanding share it has.

In terms of Tesla.

- Tesla: 112

- Amazon: 35

- Microsoft: 31

- Google: 20

- GM: 7.7

- Toyota: 7.4

- BMW: 7.3

- Honda: 6.9

- Ford: 6.8

- Mercedes-Benz: 5.8

- Subaru: 5.4

- Hyundai: 3.0

So, let’s be incredibly generous and say that Tesla should have a P/E ratio that’s similar to a well run auto company, like 7. For it to have that P/E ratio, its stock price should be about $14 per share, not $228. If Tesla lost 94% of its value, it would have a P/E ratio similar to a well-run car company that made good cars with an anonymous CEO that nobody hates.

But, just pretend it’s a tech company, not a car company. (Bullshit, obviously, but just pretend.) It is still overvalued by a factor of 4-5 compared to other big tech companies.

Somebody’s going to make mountains of money shorting Tesla stock. The problem is that markets can remain irrational longer than most people can remain solvent.

And to add onto this, very high P/E ratios can often indicate a stock is artificially overvalued. Typical p/e’s on the DJIA average out to around 20, and most companies will have P/E’s between 5 to 30… a P/E of 90 indicates a huge, huge value bubble.

BuT bUt BuT tHiNk AbOuT tHe MaSsIvE dIvIdEnD pOtEnTiAl WhEn ItS tEcH fUlLy MaTuReS! iT mAkEs Me FeEl LiKe I gEt To OwN sUm SpAcEx ToO!!!

Musk basically ate through the massive bump he got after Trump’s Nov 4th win.

The real pain for that stock is coming. It was already way overpriced before the election, and the speculators pumped it up even more.

Also consider that if you bought the stock mid December 2020, it’s the exact same value today!!!

That’s a return to where it was more than 4 years ago. 😋Remember, they had a 5:1 split in Aug 2020 and a 3:1 split in Aug 2022.

If you bought in Dec 2020, your share volume tripled.

Every consumer stock ticker I’ve seen already factors those splits into the pricing scheme

Good point. I’m a moron.

Chin up, you’re both more well versed this arcanery than I.

Good point. I

m a moronmade a mistake.FTFY

Damn Lemmy users and their damn empathy and compassion.

Ah OK, I didn’t know that.

It is the most overvalued stock in the world and its not even close.

Rats fleeing a sinking ship.

This is exactly what I came here to post!

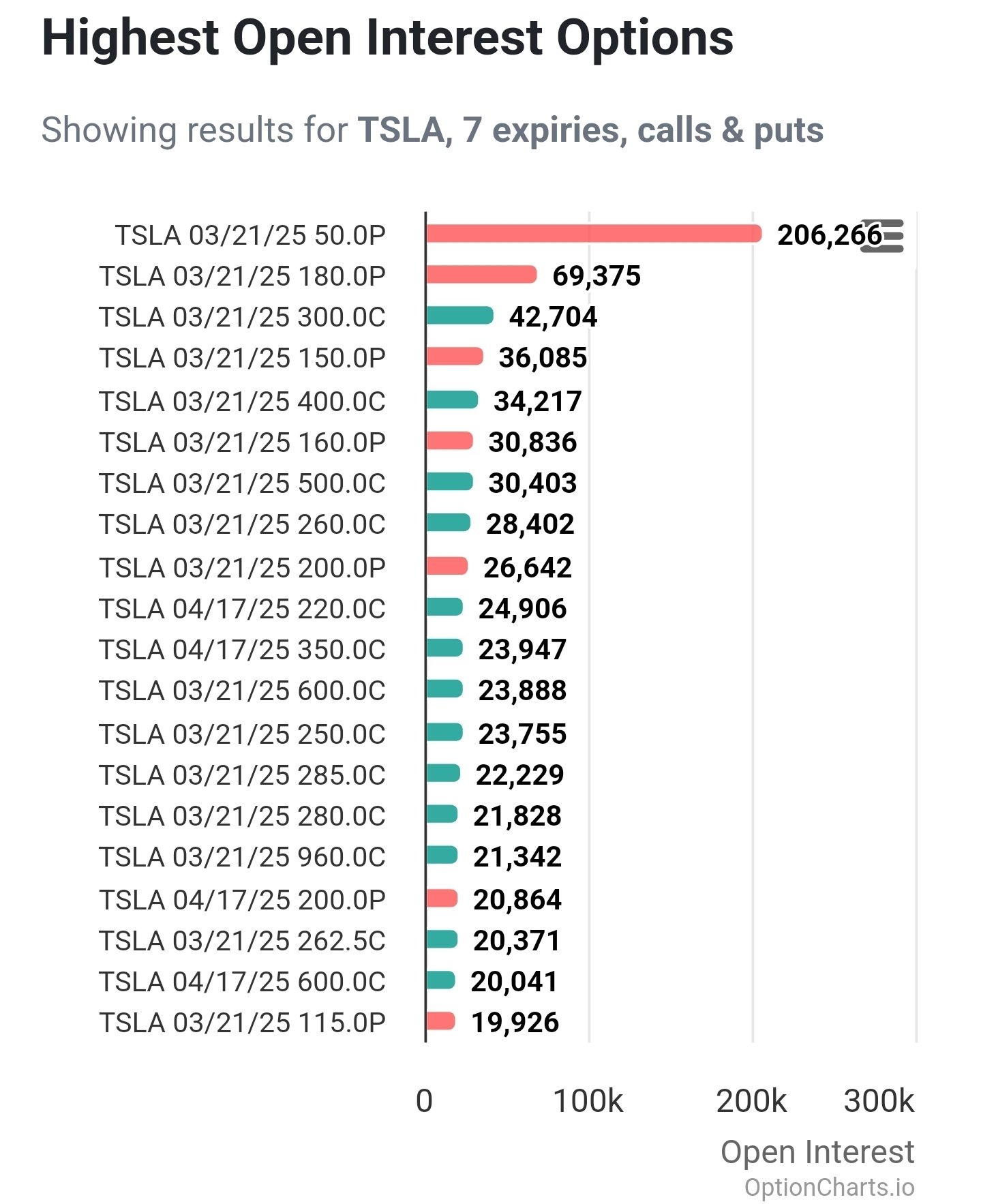

I wanted to join the selloff party so badly, I traded all my Total Market ETF holdings for (Tesla-free) Large Cap Value ETFs, and with the change left over I bought the cheapest Tesla Puts I could find.

I just love that open pessimism for Friday’s Put contracts!

I recognize that these are words. That’s probably why I’m poor.

I am mostly a disciple of Boglehead investing philosophy.

A seminal resource early in my adult life was The Wealthy Barber, which I think still stands up well as a sensible guide to low-stress, long-term investing.

An ETF is basically a thing you buy, like shares of stock, but each share of an ETF is made of a blend of a bunch of stocks. VTI is an ETF run by the brokerage Vanguard that tries to track the entire US stock market, weighted against how large a company is. You should try to find ETFs with a low “expense ratio”, which is basically the management fee for a blended fund. VTI is really low, something like 0.03%. So you pay vanguard $3 for every $10,000 gained (I think it works like that, anyway. All I know is it’s low and that’s good).

I don’t endorse playing with Options Contracts unless you have an iron stomach and incredible self discipline. It’s legalized gambling in my view (although it has other valid uses, like hedging against losses…but it’s an advanced tool and can wreak havoc on savings when used poorly).

I’m going to spend my money on more whiskey. I’m not sure if I’m too sober to understand or not nearly sober enough but we’re about to find out together.

So real talk, and of course I’m not going to toss my life savings (ha hahahahaha ha cries in american) into it but: how advisable is short selling Tesla right now and is there a reasonably “safe” way to do it? I know it always involves risk, especially in the event of a margin call, but for someone who is only slightly versed in these matter: how advisable would such a move be?

Is it possible or likely for a reverse-Gamestop ploy to take place?

I personally will never short anything. I’m not smart enough to do it right, I proved that to myself when I tried to actively invest. Were I to play the market again, if I were pessimistic about a stock, I would opt to buy Put Options to bet against it. Those come with their own risks, including being able to time the market in addition to its direction. I’ve seen others say you can buy positions in a ticker that tracks the inverse of Tesla, but it insulates you from the worst case of selling short (i.e. theoretical infinite loss, or at least way more loss than you could afford); it can only drop to zero for a 100% loss, but not more. At least, that’s my understanding, but I could be wrong. The advice I give myself is to just not play, except in the most boring way.

Looking into the sale by James he shared in his form 4 filing that his sale was to cover the transaction cost in exercising his non-qualified stock options (NSO). This sale results in closing part* of his NSO grant and acquisition of 477,011 shares. The net cash value of the sale comes out to $196k. This should result in ordinary income tax of roughly $42M.

* I’m not actually sure how NSOs work here. It’s unclear to me if there are still exercisable options in this grant or any other outstanding grants.

The shares were sold to cover the exercise price relating to the exercise of stock options to purchase 531,787 shares, which are scheduled to expire in 2025.

https://www.sec.gov/Archives/edgar/data/1318605/000177134025000004/xslF345X05/edgardoc.xml

Are we still pretending this wasn’t the plan all along? I predicted this a long time ago, and I’m a dummy.

Here it is. The only part I missed was Musk leaving the company. But the day is still young.

There’s a hole in that theory. musk has secured billions of credit with his Tesla shares. If Tesla goes down, musk goes down

If musk owes the bank a million dollars, musk has a problem. If musk owes the bank billions of dollars, it’s the banks problem.

In other words, the banks will bend over backwards to support him, his businesses, and his loans, whatever gives them the best chance of collecting.

Yes, he will have to sell stock, which further continues the death spiral of tesla and musk. Genius hasnt deversified and is all in on Tesla and is in debt. “The richest man on earth” is just his stocks. When he loses that, he lost everything.

The bank doesnt care, they will get their money. musk does indeed care.

And Saudi and Qatar princes.

Sounds like someone had some put options come up…

Rats, sinking ships, etc.