We need taxes for all - also the super-rich.

“Tax the rich” is an official EU petition. The EU Parliament has to deal with it when successful.

7 EU countries must reach the quorum. And in total 1M Votes are needed. Check yours in the chart and share, cross post etc.!

The petition calls for the introduction of a wealth tax on very large fortunes. Sign the petition here

Ideally we should massively share it in communities of the top 5 countries where the threshold wasn’t reach.

So Denmark, Belgium, Italy, Netherlands and Slovenia.

But it’s too late it end in 1.5 weeks.Je viens de poster sur !belgique@jlai.lu, on verra si ça a un effet

Tu peux voir le feed temps réel sur le site.

That’s great!

Any reason that people who have lived in Europe for decades, but weren’t born here, can’t sign this? That’s a fucktonne of people

If they have citizenship in any EU member state they can. Otherwise unfortunately no.

J’ai pas l’impression que ca a beaucoup bougé :/

Lol malta being last is so fitting.

If only the Italian man who went there taught them about class inequality

The petition also needs to go over 1million signatures. So French and Germans signatures help as well.

Already signed!

signed

Edit/commentary: I understand that this proposal is less than ideal, because “tax the rich” is not going to solve the problem. We need a reform of our basic principles of economy. But it’s a sign that something must be done against the inequality.

Only people living in Malta are billionaires

You think everyone wants this but that’s just not the case

+1 from Belgium!

Slovenia ahead of Croatia! Let’s goooo, all I care about!

Europeans don’t care. they just want to complain.

P.S signed

i believe they might not know that this is important and will affect folks who earn around 1000€ passively from interests… per day ^^

It’s not that I don’t care, I just haven’t even heard about this until now.

Maybe they don’t hate the rich?

The question is: Why should I care?

is it fair being born with wealth that pays you a daily interest that others work for a whole month?

If this wealth was legitimately earned by your parents? Yes it is fair. Supporting your children is your sacred right.

Please explain how one legitimately earned 10 Million.

10millions is not an insurmountable amount if you are smart enough to get a good job and are smart enough when investing your money.

Usually by starting a company that produced valuable goods and services benefitting everyone and profiting off of it.

You can also gamble but thats by definition a losing game

Hey ho I have a paper for you

We demonstrate that chance alone, combined with the deterministic effects of compounding returns, can lead to unlimited concentration of wealth, such that the percentage of all wealth owned by a few entrepreneurs eventually approaches 100%.

…note no skill required. Conversely, hustling won’t get you there.

We show that a tax on large inherited fortunes, applied to a small portion of the most fortunate in the population, can efficiently arrest the concentration of wealth at intermediate levels.

So we don’t even have to hit millionaire kids. Inheriting 5-10 million a head is fine, systemically speaking. And if you think that your kids are better off with more money I sincerely feel sorry for you.

…note no skill required. Conversely, hustling won’t get you there.

You didn’t read that paper. From fast skimming I can clearly see that their simplified model didn’t check for impact of skill at all.

It says nothing about real world except there’s a wealth concentrating factor of being ahead. Other factors are ignored

Interesting that every country that was in the Soviet bloc doesn’t want a bar of this

RDA was part of the soviet block, but we don’t have stats based on regions I guess

Can someone tell me, where I can look up whether I have already signed or not?

Or do they remove duplicates automatically?

This is why they teach Spanish in American high schools /s

This is probably why Switzerland is not in the EU. LOL.

I’m not against this initiative per se. But this is just another tax on middle class people and doesn’t tackle the real wealth being hidden in multinationals that don’t pay any tax and hold governments hostage by threat of moving their employment away. They are the problem. They pollute like no other because no one is ever held accountable.

What makes you say it’s a just another tax on the middle class?

Again, I’m not against this initiative in it’s entirety. I’m just remarking it doesn’t tackle the real problem. And to answer your question, having savings around a million euros isn’t weird for western Europeans. The standard of living here is fairly high. The average starter home is around 400k euros where I live. Meaning regular 4 people family homes are almost double that. Again. I’m not against this proposal. But it’s just populist pandering. Most people just read the title and go “yeah eat the rich”. I know Paul Magnette. I’d never vote for him cause he’s not a sincere politician. He’s a populist. It’s the modern political disease, they’re all populists. No one is honest anymore. They’re all there in your face just to get votes. This proposal is nothing more than a simple ad and power grab. I wish it were different. I really do. The real problem is that no one who works for someone else earns their fair share. Corrupt governments won’t solve this.

Thanks for the context. And I have no idea who Paul Magnette is so I’ll take your word for it.

I think your point about cost of family homes makes sense. If that is the case it might need an adjustment.

I have no experience with economic systems, but I wonder what the effect on home prices would be if taxed at the levels proposed. My hunch would be that home prices would decrease. The risk is of course that families with less financial means that borrowed money to afford a home will loose money.

Regardless, the main problem is extreme wealth disparity. My question is mainly, are the home prices high because wealth is high?

I dont know where this OP is living but having a million Euros in savings is definitely NOT normal, nor is it “middle-class”. Yes the houses can cost that much, most are mortgaged and the owners saddles with half a million in debt, desperately hoping for the prices to rise to make a profit. And there’s a significant housing shortage in several western euro countries too.

Rich people usually dont have their wealth laying around on a savings account, but rather own shares of a company or property or something else, but not cash. If you’re lucky and bought a house in a metropolitan area a few decades ago, it’s also not unlikely that you’re a millionaire on paper with a normal middle class income. Just having double the income of the average isn’t that absurd, some people just earn a little more than others. The real issue is waaaaay above this level of wealth. Not the 60y/o guy who has a few hundred thousand in his pension savings.

This much money is unhealthy to have, not middle class

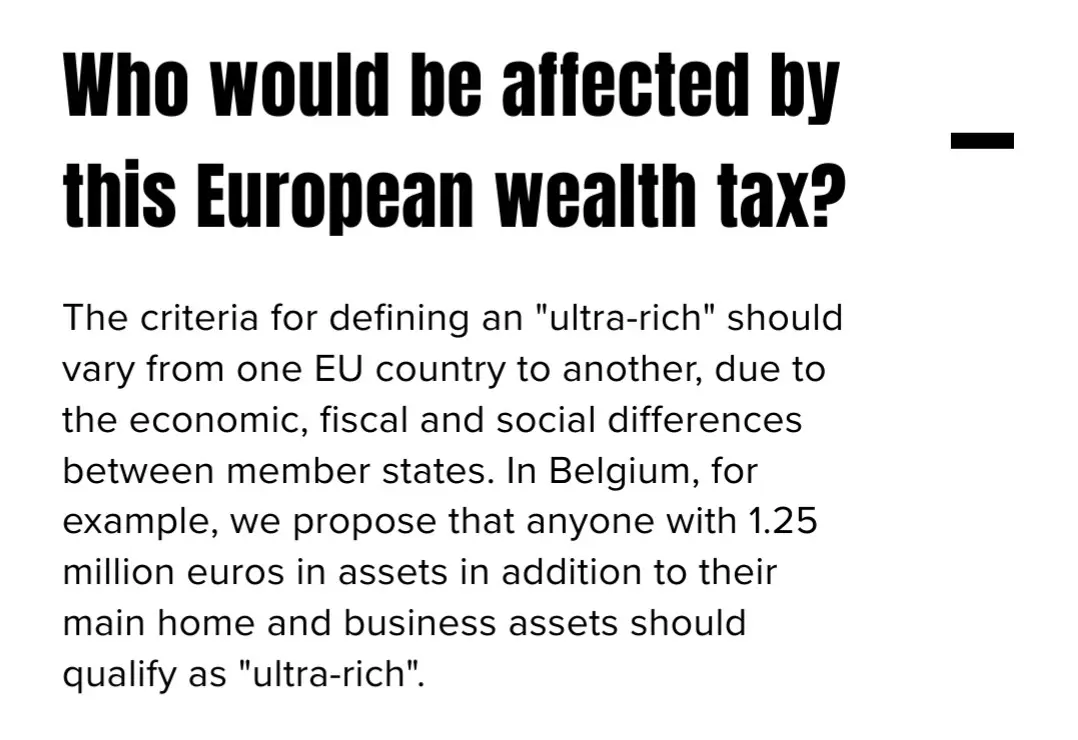

From https://www.tax-the-rich.eu/home#info

What a bad initiative. This would basically guarantee that people in Europe can’t ever retire on a modest income.

1.25 million euros per person on top of your main home doesn’t allow you to retire?

It’s probably not so much you can’t retire, but you can’t retire with an income that you’ll be comfortable on.

A brief look suggests the average pre-tax wage in Belgium is around €3800, or about €45000 per year. Assuming you already own your home, or continue to pay mortgage payments at the same rate as before retirement, your pension needs to roughly match your income to not have a drop in living standards. A €1250000 pension pot will buy an annuity that pays a bit more than that, probably around €55000 a year, but assuming you amassed that in your pension pot you would probably have been on a higher than average salary, so it’s going to be close, and an annuity at that level wont increase with inflation, so your buying power drops over time, just when you’re more likely to need a care home or nursing support.

Belgium has public pensions with a minimum of €1,549 per month (https://www.brusselstimes.com/344282/monthly-pension-in-belgium-to-top-e1500)

You seem to assume that 1.25 millions is supposed to be your only income, but that’s not the case.

A really rough calculation (and I acknowledge I could be somewhat off here) suggests that if you contribute for 40 years, and get around 5% interest per year, you’d need to put in an average of €10,000 per year to reach €1,250,000. Working out average salary progression through a working life is left as an exercise for the interested reader, but assuming you’re putting 10% of your salary into your pension, you’d need to be earning six figures to make that pension pot, so a drop to around €73,000 including the public pension could be hard to manage.

As I said, not so much can’t retire, as can’t retire at the same standard of living, especially as annuity payments wouldn’t increase with inflation.

This just qualifies as ultra-rich - which is not wrong, imho. I don’t know the exact conditions for Belgium but in Germany the taxes would start to show effect at 4,6 million with 2%. If you think about it assets in this magnitude could easily lead to 1000€ daily passive income. Those 2% wont hurt.

But it doesn’t include the home or business assets. So you could have one guy with €1.25 million in stocks who lives off a modest income from dividends and sleeps in an RV and he would be classified as ultra rich.

Another guy could live in a €2 million mansion and be the owner of a €100 million business (but have no other investments) and be classified as NOT ultra rich. See the problem?

Yeah, the problem is you’re shooting down a great initiative with an edge cases that affects maybe a couple dozen RV sleeping millionaires. Maybe he should participate and contribute to society!

Edge cases are what these guys used to get their fortunes in the first place. The more common term for these is tax loopholes! Everyone knows that big corporations like Apple use them (“Double Irish” being the most infamous) but individuals use them all the time.

Anyway, the point I’m making is that I really don’t care about the RV sleeping millionaire, I care about taxing the 200 millionaire business owner I mentioned who would currently be exempt. Because of the loophole, you can bet that all of the “ultra-rich” are going to restructure their investments into a single business they own so that they can completely exempt themselves from the tax.

Yeah, start with this law then close loopholes. It’s like you’re climbing a cliff, you don’t leap straight to the top you get handholds where you can find them and make your way up.

Why should someone be able to live off dividends if they have “ultra-rich” wealth at the bank? This person has a lot of money so if they live in an RV it’s obviously a choice they made.

Plus they could just spend some of that stock money and go below “ultra rich” level and get taxed less. And perhaps then they have to use part of their non-ultra-rich wealth to live their RV dream life to supplement their dividends. Doesn’t sound too bad.

TLDR; I don’t feel bad for someone that can’t live dividends when hey have more than one million euro in the bank.

Edit: while is still stand by comment, I do see I missed your point about fairness. Not too big of a problem in my mind. Or perhaps a solution would be to tax home values above X amount? (Edit2: and only the amount above X)

Reposting my comment below because it seems people aren’t aware of this

Belgium has public pensions with a minimum of €1,549 per month (https://www.brusselstimes.com/344282/monthly-pension-in-belgium-to-top-e1500)

You seem to assume that 1.25 millions is supposed to be your only income, but that’s not the case.

This initiative is a total garbage for two reasons:

-

Taxing unrealized gains is immoral and a LOT of people won’t ever sign this petition

-

Expect the great exodus of capital from the EU if such proposal ever passes.

Point 2 is always what people fear monger when taxes being raised is brought up.

Gerard Depardieu became russian citizen when France introduced 75% tax on his income

https://www.france24.com/en/20140530-exiled-french-actor-depardieu-pay-just-6-tax-russia

And this is just one high profile example. Im sure there were a lot more like him

That news is 10 years old.

In the meantime, Macron removed the wealth tax.

Did Depardieu come back to France? There are other places to avoid wealth tax in Europe. Depardieu first moved to Belgium, why go all the way to Russia? Seems to be more than just tax reasons. He is also now a citizen of a United Arab Emirates.

Did Depardieu come back to France?

Why should he trust french government not to screw him over?

That news is 10 years old.

Yes, but it doesn’t invalitate it in any way.

Depardieu is a wanker who was practicing tax evasion long before he left.

We don’t need useless piles of garbage like him.

We don’t need useless piles of garbage like him.

You do want his money tho - hence the attempt of 75% tax rate. But you aren’t getting any of his income, he doesn’t pay his taxes in france anymore.

It’s ok, these faux french cunts can fuck off to another country. Makes room for people who actually care about the country.

We weren’t getting any of this fraudster’s money anyway.

If anything he cost us more money than anything in fake grants.

So you have a horrible legal system, and he’s great scapegoat to divert attention from fraud underneath? Am I missing something?

Your brain, for sure.

So…Elon musk instead of paying $0 income tax as an American citizen would pay $0 as an expat?

paying $0 income tax as an American

Let me guess - he borrows against his assets so it isn’t taxable income? That’s a pathology in the legal system. He should absolutely pay regular income tax on this. But regular income tax isn’t the same as proposed wealth tax

That is the thing that need to change, but how do you legislate that without fucking up the little guy with 100k. Or the random dude making HELPC that’s going to be taxed harshly?

That is the thing that need to change, but how do you legislate that

Simple, when he dies, during the inheritance proceedings, all debts should be paid off from the sold assets, and the due income tax collected as if he sold these assets himself when he was alive, creating the taxable income.

LMAO, you think they pay inheritance?

Also, what a solution: let them extract wealth and not pay for 80-100 years. Then we can finally do something. Do you even realise how ridiculous that sounds?

-