Saw a post about this at !history@hexbear.net and was a bit confused by exactly how badly the people there were going at each others throats in the comments. Nobody seemed able to agree on what precisely happened in 1971. Suggested explanations included:

- Neoliberalism being declared the state religion by Grand Moff Richard Nixon

- The gold standard being abolished

- The oil crisis

- The Republican and Democrat parties becoming increasingly divided

- Declining birthrates

- Institutional Racism

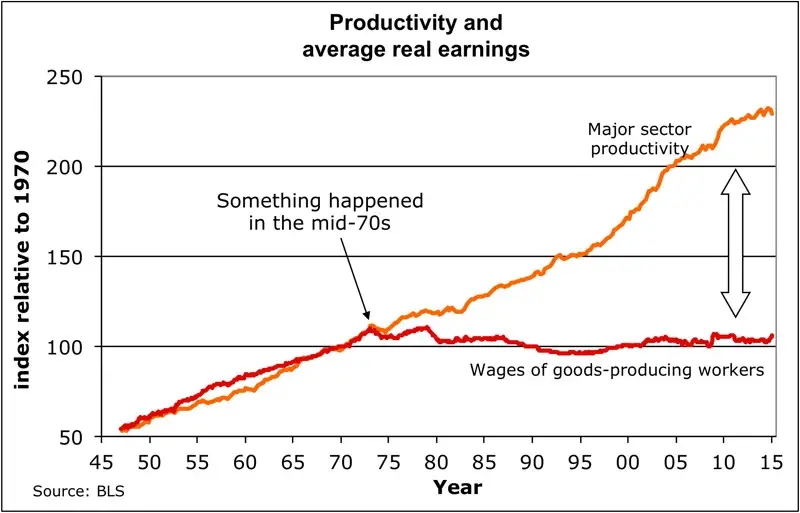

If any of you could give some explanations with, like, sources that aren’t just 10 pages of graphs with arrows pointing at 1971, that would be pretty great.

From ChatGPT:

Ending the Bretton Woods system in 1971 had a cascading effect on corporate profits and income distribution. Wealth shifting toward shareholders and executives rather than workers:

1. Deregulation of Money and Credit

Once the dollar was no longer tied to gold, the U.S. government and Federal Reserve had more flexibility in managing the money supply. This led to:

• Higher inflation, which eroded workers’ real wages.

• Easier access to credit, fueling corporate financialization (more focus on stock buybacks, mergers, and financial engineering instead of wage growth).

2. Rise of Shareholder Capitalism

With the shift away from the gold standard, corporate governance changed. Instead of focusing on long-term growth and worker stability, companies prioritized maximizing shareholder value, which became a dominant ideology by the 1980s (reinforced by Milton Friedman’s theories).

• Stock Buybacks & Dividends – Companies increasingly used profits to buy back shares, boosting stock prices and benefiting executives/shareholders.

• Executive Compensation in Stocks – CEO pay shifted from salaries to stock options, aligning their interests with shareholders rather than employees.

3. Decline in Labor’s Bargaining Power

As globalization and automation accelerated, companies could move production abroad, weakening the leverage of American workers. Meanwhile:

• Unions declined, further reducing workers’ ability to demand wage increases.

• Deregulation in industries like finance, airlines, and trucking shifted power away from labor and toward corporate management.

4. Explosion of Financialization

The detachment from gold allowed an unrestricted credit boom, fueling speculative bubbles and making the financial sector more dominant. Instead of reinvesting profits into worker wages or capital expansion, firms:

• Focused on financial activities (derivatives, leveraged buyouts, etc.), which benefited investors rather than workers.

• Moved toward short-term profits, cutting costs via outsourcing and automation.

End Result

With productivity still rising but wages stagnating, the gains went disproportionately to executives and shareholders. This is why, after 1971, you see charts showing a widening gap between worker pay and corporate profits.

I hate these LLMs but must admit that’s a damn fine synopsis

Probably the best thing I’ve seen out of GPT so far.