I was horrified by the contents of one of my Finnish mutual funds when I looked into it after years of disinterest. I’m especially disgusted by UnitedHealth Group Inc - the health insurance company whose mass murderer CEO got shot recently, sparking nationwide cheers.

As a passive investor, you’ll forget your money into the wrong hands when the bank won’t remind you of developments in the political situation.

Ålandsbanken promises:

“socially sustainable”

You may assume your bank is civilised, but you should have a closer look. I’m a customer of S-bank in Finland. In this case, the fund ended up under a different Finnish bank twice due to buyouts, and the management of the fund ended up in a Canadian bank branch in the UK.

My other bank didn’t recommend selling my Russian investment when Putin’s reign had started going overdue after his full term as a president. Luckily I was awake and sold everything.

Investments drift out of balance over time. Within mutual funds, there are limits, but the funds grow at different rates. You should re-balance your diversification once in a while to avoid excessive country risk.

I don’t know if fund managers are bribed to distort the balance within the fund’s limits for the benefit of a third party.

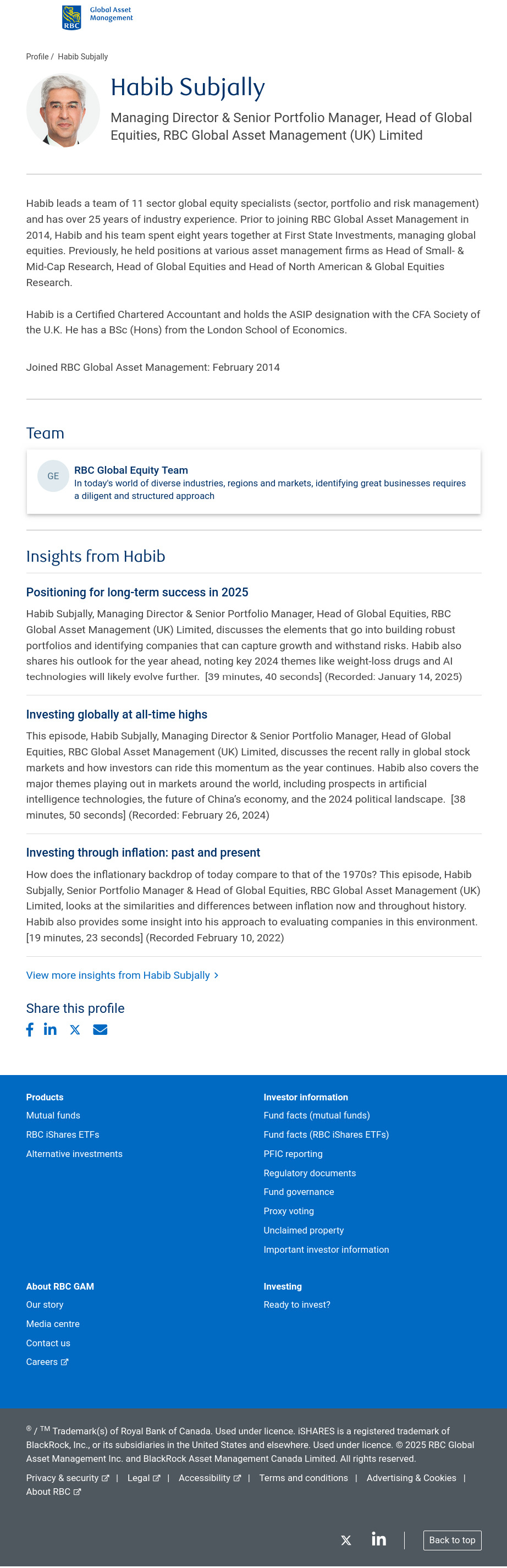

My fund is managed by that guy. I sold everything. Will reinvest in Europe.

The activity can be limited, and so can the risk:

Once in about 5 years, buy a diversified portfolio of 30 companies in at least 10 countries on at least 2 continents in at least 3 unrelated industries, and forget for 5 years.

Maybe prefer to buy in a depression and sell on a bubble if you’re feeling extra active. Just be sure to diversify in time to avoid accidentally investing everything on top of a bubble.

It’s easy nowadays through many banks’ websites. I use Nordnet.

Between stock sprees, save into a regular savings account.