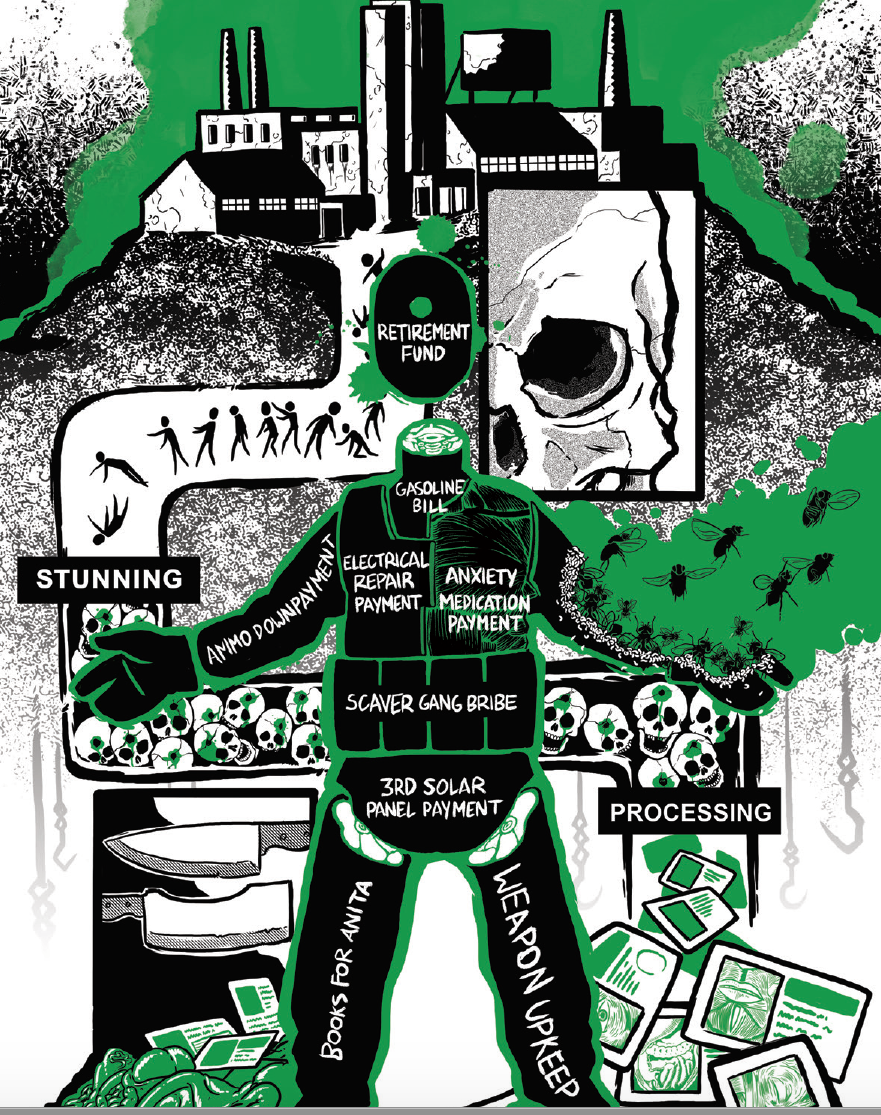

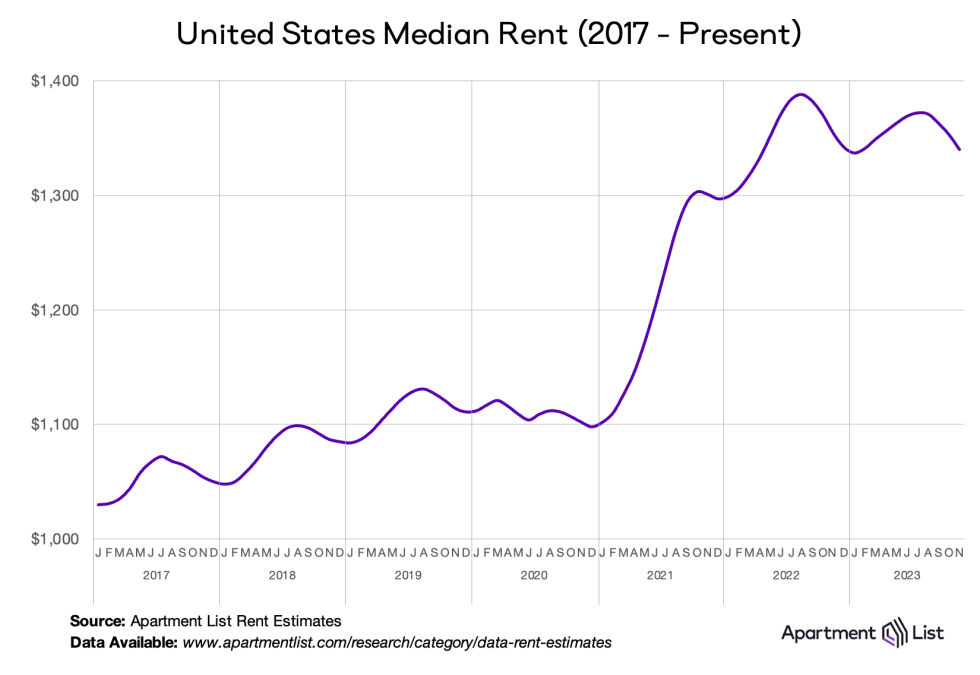

100 - >150 -> 148

So much win

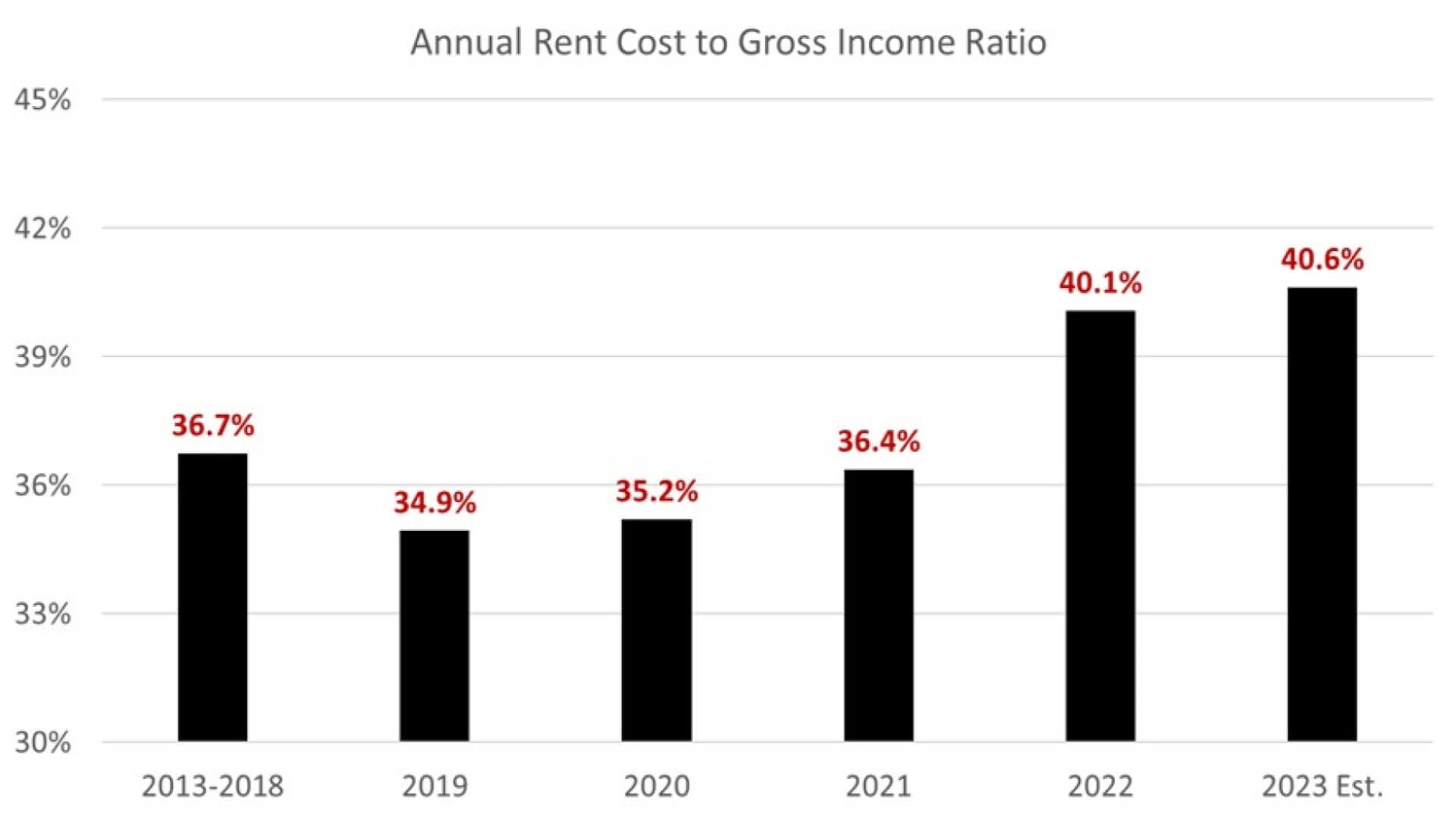

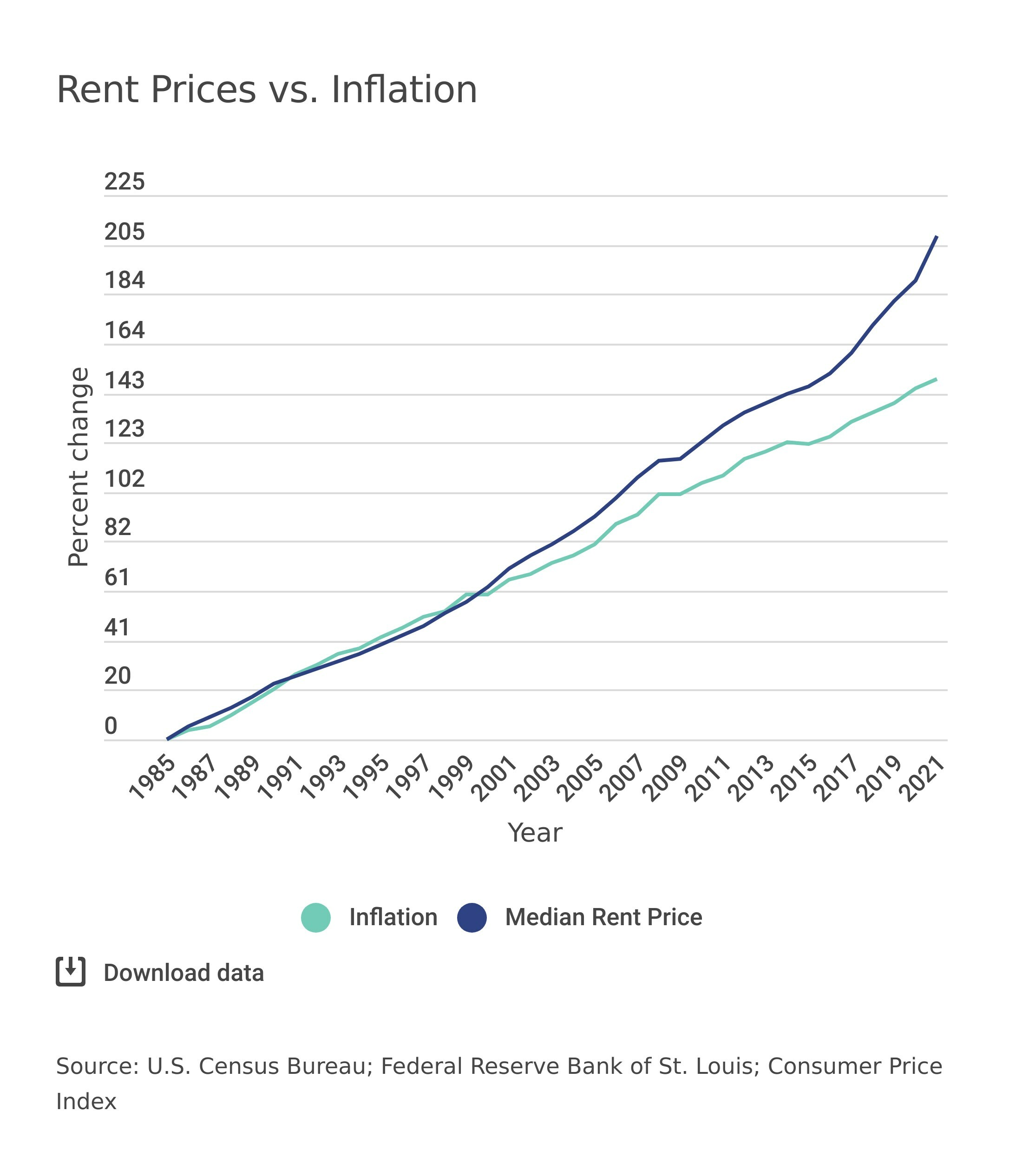

Another chart from the same article which he didn’t show

Surely wages also increased by 30-40%, right?

Getting hit by a car, but it stopped accelerating at 60 kph

rent goes up $1000

rent goes down $500

omg rent is so cheap now!!!

It’s not even that it went back down, it just stopped rising. Rent isn’t any cheaper that it was last year

Mine didn’t stop rising

i had some items in my amazon cart. they’ve just been sitting there for weeks now because i’m avoiding buying from amazon for awhile. $16 total.

black friday came and the original $16 price tag is now a BLACK FRIDAY DEAL -24% at $16 ONLY FOR PRIME MEMBERS!

i ignored it. on monday the original $16 then turned into a CYBER MONDAY DEAL -24% at $16.

legit just checked. all the “deals” are now over. it’s still $16…

Lotta digital stores do this

Amazon in particular are notorious for price jacking during/near holiday sales to put items on ‘sale’

“Just get a raise to catch up, if you can’t then that’s your own problem.”

But don’t everyone do it at once, or we’ll have inflation again and I’ll have to raise your rent.

It’s almost like capitalism requires a vast exploited underclass to function.

I would fight someone for 1000 dollar rent

I think their example means the rent goes up by $1000.

Oh yeah, I probably should comment first thing in the morning after a night of smoking huh

It’s even worse, it’s more like rent went down $50 in your example

A lot of coverage of inflation (and also GDP growth) intentionally muddles & conflates change in rate of change (second derivative) vs. change in value (first derivative) vs. actual value (zeroeth/no derivative, actual thing being measured). Pundits basically pick one of these three values at random to support whatever position they’re hawking and nobody bothers to think about what the difference is.

Lost count of how many people I’ve seen say something like “if inflation is down now why is everything still so expensive?”

This type of guy fascinates the hell out of me, getting owned so hard all the time by so many people, constantly being proven stupid and wrong, but he lacks the self-awareness to recognize how embarrassing it all is for him.

i kind of wish i had that capacity, it must be nice to live shamelessly

Yeah, I’m sure he’s happier than I am despite being wrong all the time

I think he is intentionally obtuse and is trying to push landlords talking points

He’s like the chief “owned” guy on social media lately, on more than just landlord issues though

This is so fucking idiotic.

I hate hearing about rent ‘deflation’ from these econ bros. I’ve never experienced my rent or know anyone whose rent was reduced, except by court order, but almost everyone’s rent increases per year like clockwork. Maybe the only way to get a cheaper rent is to move at the right time but then you have to pay the cost of moving, which is expensive, not to mention time and energy consuming. But you can’t afford to move if you’re paying exorbitant rents every month either, and moving to a place that is $500 cheaper is eventually not going to last because of rent increases and depending on how far and how much you have to move then you may have just burned a lot of the long-term potential savings upfront. These hot takes over some dumb graph is useless or unrealistic to most people, since it probably includes the lowest rents in the most economically abandoned parts of a large country. Most people have to face an inordinate monthly rent bill even in moderate cities, not to mention the largest metropolises like New York and Los Angeles, no one gives a shit about the national statistic when their local and immediate condition is costing half or more of their monthly income and is only getting worse. It’s like that guy claiming inflation was defeated if you don’t consider all the necessary costs people have to pay, like housing or food, fuck you.

These apologists should be among the first in the gulags.

my rent went down by $50 for the first time in my entire life this year and the way management reacts whenever they hear about this fact I’m 99% sure it was a computer glitch. probably will jack up our rent more to fuck us over next year.

I’m honestly happy for you, and I believe you, but you’re an extremely rare anomaly which I’ve never heard of actually happening but I guess it does happen then. Kind of like ancaps with Milei.

Out of curiosity, do you live in a major city or do you have rent control? I’m guessing from what you said about your management that they didn’t give you an explanation as to why it was reduced, it could have likely been a glitch since some companies use algorithms to set their rents. I hope they don’t raise your rent next year but I’d be very interested to hear a follow-up.

yeah I live in a non-rent-controlled apartment building, I meant building management. what I think happened is the building was bought a few months ago by some random private equity group in the northeast, and coincidentally our rent renewed during the handover when all the websites and portals and whatever were in flux. I think their valuation models for our rent probably didn’t have access to our current rent rates or something so we ended up being assigned a rent decrease. From asking around we are literally the only people in our building this happened to and building management was shocked when they found out.

Oh, yeah, man. That was 100% a bug and nothing like an actual rent reduction. You got lucky but hopefully they don’t get their revenge next year.

The same thing happened to me a few years ago, pretty much exactly. Apartment complex bought by a private equity firm, renewal came up during the transition, rent went down by a tiny amount. The previous (i.e. non-equity) owners kept incredibly shitty records, so my guess was that the new vampires just had to guess at a “fair market value” and fucked up.

we’ve found the secret, just convince these ghouls to incessantly play building hot potato with each other until everybody’s rent goes down by fifty bucks

this is the first time i’ve ever heard of anyone ever having their rent go down. the gods have smiled upon you.

use the 50$ to burn your landlords house down.

Here’s a graph for ya

turns graph upside down

see? idiot

tis i who is the idiot

Chuds: YUP LOOKS ALL GOOD TO ME

Chuds aren’t the ones writing daily op eds explaining why you’re an idiot if you don’t think the economy is doing great.

Yes you are right, but chuds are for sure the ones defending “number go up, must be good” bs

Well that was under Trump.

Now a dems president the economy sucks again because gas isn’t $2.

The economy does suck but not for the reasons they think, it sucks for the same reason it sucked under Trump which they loved.

What do you mean? Trump was good. He was draining the swamp.

“Well sure rent increased by 20% for a year there but now it’s dropping by 2%! That balances it out!”

Also goddamn wish I got an 18% raise every year.

Smartest “economics” liberals don’t understand that rates turn into prices by accumulating them over time lol.

That “one-time” spike, cumulatively, looks like a big permanent rent increase.

If this was happening in China, Westoid China Watchers would be publishing doom and gloom articles about how the collapsing property sector is going to cause the Chinese economy to go into a death spiral.

I know this because that’s exactly what’s happening right now.

Even funnier when you consider that housing and rent is about 15-20% of US GDP, including “virtual rent”, which is imaginary rent which is counted in GDP. Literally imaginary in that it measures home owners living in their own houses paying rent to themselves.

Imputed Rent

No one I have told about this had ever even heard of the concept.

USA has higher GDP than China… If we measure in nominal US dollars and pretend that every homeowner in the US pays themselves rent.

I wonder how much China’s GDP would increase if you counted all the homeowners (which is like 80% of the population) as paying fictional rent to themselves.

While China doesn’t calculate their gdp statistics the same way as the US, I believe they do also include imputed rent in the calculation https://www.thefreelibrary.com/Reestimating+China’s+underestimated+consumption.-a0407668620

It is capital that is being put to productive use, I think including it in gdp is fair

Neoclassical economics on hexbear!?

The cost of rents increasing is not something you want to be padding your gdp (nearly 10%). This only benefits the FIRE sector while making production more expensive, necessitates an increase in wages or greater deprivation, and produces more unearned income and rent seeking.

How exactly is the value of the land I sit on going up productive? I don’t have to do anything to improve it, I can live in a shack, but because the price of the land increases I am somehow engaged in a productive use of capital? The only winner there is myself and the bank, when I sell the property for 10x and the next owner has a 30 year mortgage to live in the same shack. I guess the state also benefits because the fake dollars in rent I pay each month keeps going up and so to does their gdp. None of that is productive.

The land is productive because you are living on it. If you didn’t own the property, you would need to pay rent to live somewhere else, which would be included in gdp.

I’m not making a judgment about whether gdp itself is good or not, but including imputed rent makes sense for consistency’s sake

Economics is not a science, it is your moral duty to be anti-intellectual towards economics.

lol, I googled to see how bad it is in California - I pay 70%, and have for years - and I found a “study” by Forbes that claims California is the second-highest state at . . . 28.47%. How is that possible? Oh, here it is - they calculate it based on the average California annual income instead of the median renter income.

https://ktla.com/news/california/californians-spend-second-highest-percent-in-rent-study-says/

Here’s a better one that shows that 28.8% of Californians are “severely cost-burdened” and pay more than 50% of their income on rent:

you pay 70% of your income in rent? holy shit

That’s not that shocking. Here’s an example in London.

-

Minimum wage at 40 hours a week nets you £1667, then you minus 20% for income tax so -337 = 1330, then roughly another £100 for council tax on your rented property so down to 1230.

-

Rents can vary depending on how many tenants are in, but unless you’re living with friends, the shared houses can be a true nightmare. If you’re anywhere near actual London rather than somewhere that’s an actual Great Western train ride away (as opposed to the underground tube, which goes pretty far), then rent is going to be 700-900.

-

That leaves you with 300-500 quid, and you probably have to take the tube to work which has also gotten more expensive, so add 10 quid for every day you’re going to work - that’s roughly another 200 on travel, especially considering you’re going to be living in the outskirts so your train has to go through a lot of zones to get to work.

So you take home 500 pounds a month if you’re lucky and get a place for 700 (in a total shithole). If your rents at 900 (and possibly still in a shithole) then you’ve got a nice 300 quid left of your 1667 you started with. Plus, you probably spend two hours on the underground each day, and certain lines (Jubilee) are so loud that you’ll get damaged hearing. Eat your slop, and work, peasant!

Do you pay income tax on amounts lower than the personal allowance?

No, but the personal allowance is 12750, and with that amount of money you would struggle to rent

Still an extra £2400 spread across the year though no? Compared to taking 20% from the total income.

Yes, but you wouldn’t be able to rent anywhere for that. If rent was cheaper, then it would be viable to live off 12750 for sure.

Sort of - if you earnt 13k then you would be taxed down to 10k.

If you earnt 12750, then you aren’t taxed, but assuming rent at 800PCM you would have £3000 to live off for the year, which once you factor in heating bills if you use it, travel, council tax, London prices of goods, and so on, is not very much.

-

Look it didn’t go up as much this year. Bidenomics stays winning!

Why are you complaining?

The rate of increase is falling! Why aren’t you people happy? That massive rent increase was just a one time thing (until your lease is up for renewal)

deleted by creator

For a second, i thought the graph was

in the thumbnail.

in the thumbnail.the psychopathic tankies who feel the need to turn every debate over the economy into a blizzard of abuse think they’re winning, because they’re making more death threats, but what they’re actually doing is demonstrating why views on the economy have become so distorted

logiclords always seem to think that you can’t be correct unless you’re nice.

No offense, but it’s been social media and peer information bubbles from the very start, some of us identified the problem immediately. “Mortgages and interest rates,” by contrast, are being adopted as an explanation because it’s the last alternative even remaining

Maybe you’re just in a cope bubble of people who are well off and can abstract economic struggle into a 2016-esque theory of your social media grievances. You’ve been working at a university think-tank for 10 years. Get real.