Amendments to the PayPal Privacy Statement Effective November 27, 2024:

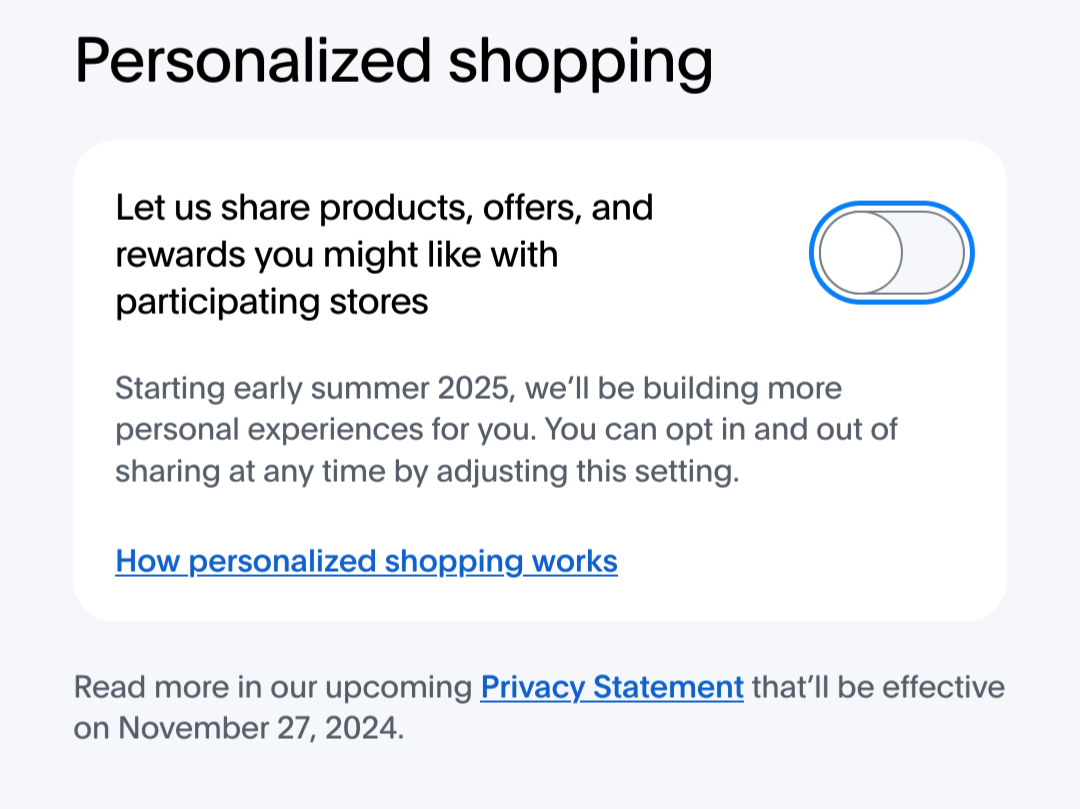

We are updating our Privacy Statement to explain how, starting early Summer 2025, we will share information to help improve your shopping experience and make it more personalized for you. The key update to the Privacy Statement explains how we will share information with merchants to personalize your shopping experience and recommend our services to you. Personal information we disclose includes, for example, products, preferences, sizes, and styles we think you’ll like. Information gathered about you after the effective date of our updated Privacy Statement, November 27, 2024, will be shared with participating stores where you shop, unless you live in California, North Dakota, or Vermont. For PayPal customers in California, North Dakota, or Vermont, we’ll only share your information with those merchants if you tell us to do so. No matter where you live, you’ll always be able to exercise your right to opt out of this data sharing by updating your preference settings in your account under “Data and Privacy.”

edit: update title to reflect this is for PayPal USA users

Just logged in, just found it, just opted out. Thanks for the heads-up OP.

But fucking fuck. Can we put a stop to this? Legally? We could call it sometime like… The National Opt-out Policy Elimination (NOPE) Act or something.

It’s called GDPR

Ah yes, that thing that sites mention on those annoying popups before making us sign away our privacy anyway.

That thing which makes Meta and Apple so scared they do not release their new products in AI anymore in the EU to pressure us to loosen up the laws. That has already been costly to these companies.

That prevents Paypal from doing this change in the EU.

The law that has been awesome so far.

Yeah, critics don’t realise that headlines like that don’t phase me at all since GDPR.

Clicking on “deny all” is well worth the positives. I think there’s even add ons that do it for you.

deleted by creator

Most of those popups are illegal, according to the GDPR. Both opt-in and opt-out need to be just as easily possible.

Exacly, these popups are completely unnecessary and just a form of malicious compliance by the website creators.

They are not even compliance a lot of the times.

They are the equivalent of begging on the street, some of them aggressive enough that it’s illegal.

It’s not illegal if it’s not being enforced.

You can pick out a company and sue them.

What? As a private citizen? in +this* economy?

Wasn’t the point of stuff like the GDPR that the governments would be the ones doing the enforcing and the suing?

Well, you can also file a formal complaint with your regional data protection officer. Usually, this is resolved outside of court, though, so it doesn’t necessarily prove that the behavior was illegal (although a judge might take the data protection officer’s opinion as expert input for future trials anyways).

No, GDPR is exactly what allows anyone to sue corporations with any chance of success and impact.

Yeah, no. You can choose to say no. A privacy banner has to give you a single click option to decline the use of your personal data and if you don’t get that option, they’re not complying to GDPR.

I systematically file complaints against unlawful privacy banners and with every popup that gets corrected I made the world a more privacy friendly place. It ain’t much but it’s an honest job.

It should have to be opt-in ☠️

Most things should be. Hell, one of Google’s biggest public failures was building an opt-out social media network that let all sorts of people see who you’ve emailed lately.

Same… So tiring. Fighting to not be someone else’s product just by existing

Where is the option?

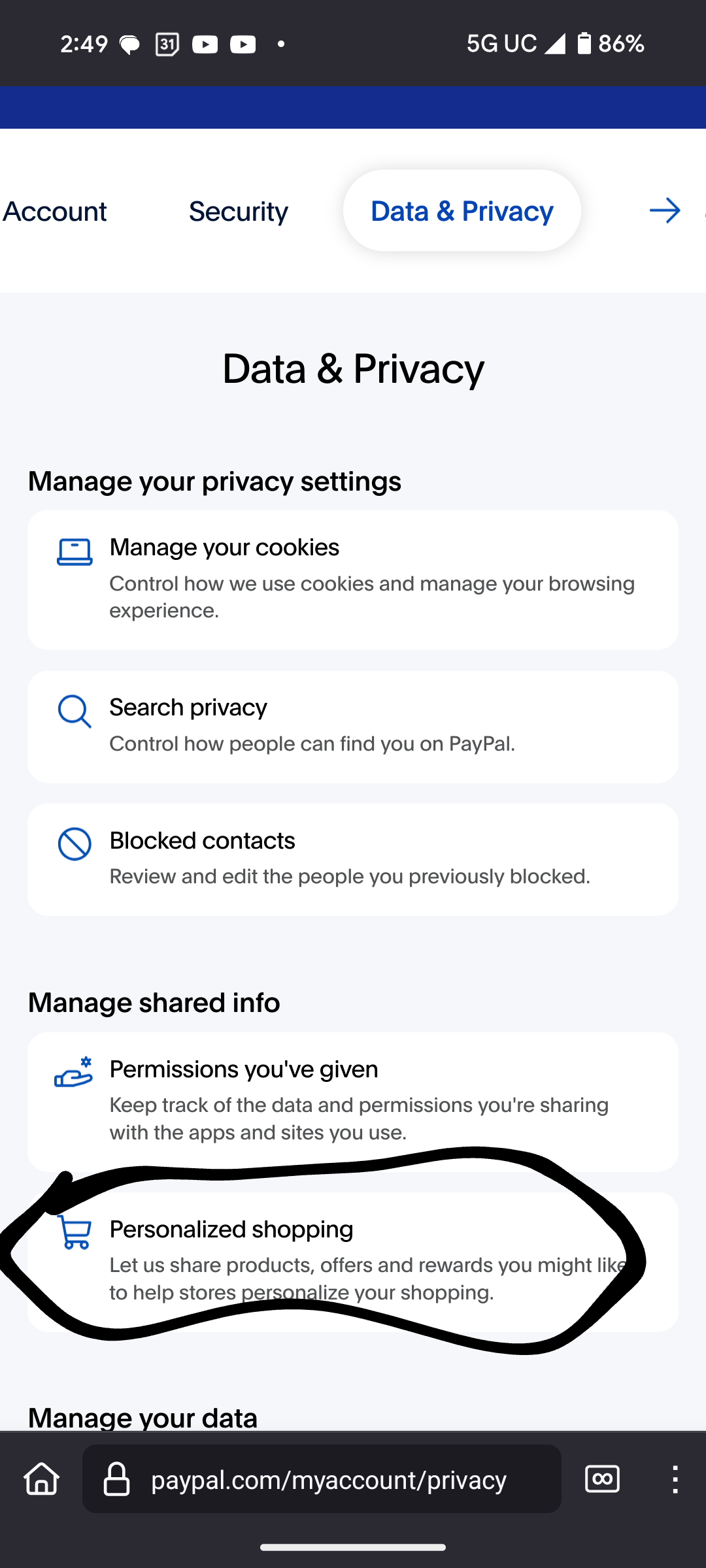

In the app - Profile - Data & Privacy - Personalized Shopping

Sigh… Not showing up for me. Is this affecting all regions?

I’m in Australia, not showing up for me.

Not showing on my page either. I wonder if this is only happening in the app and not the website.

Profile - Data & Privacy - Personalized Shopping

Thank you for this! They don’t exactly make it easy to find.

Thank you. I’m honestly surprised this link is shareable and not some application generated garbage string.

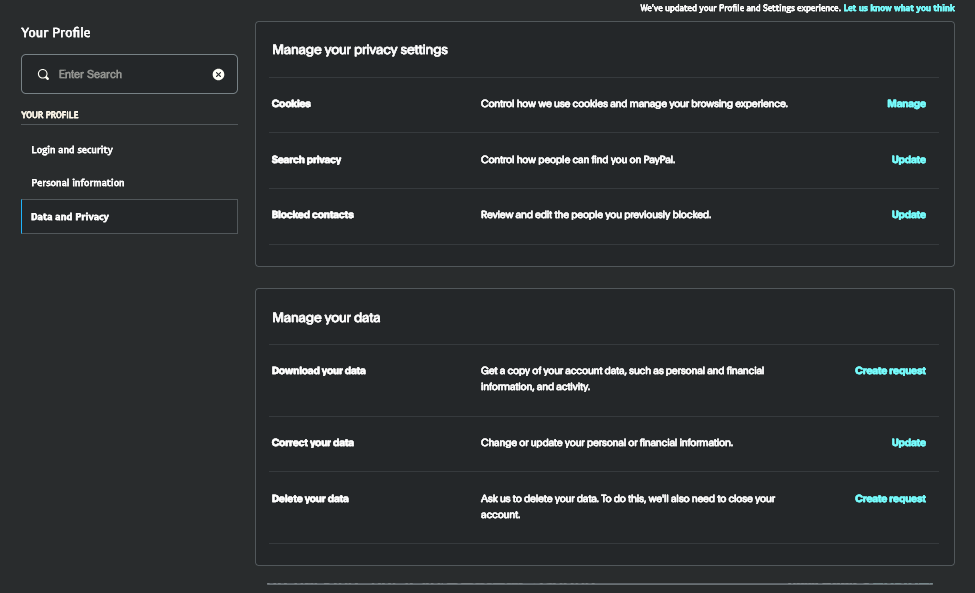

I’m not sure how you found this:

‘No matter where you live, you’ll always be able to exercise your right to opt out of this data sharing by updating your preference settings in your account under “Data and Privacy.”’

edit: apparently it’s in the app: https://lemmy.one/comment/13217994

Followed the link, the page I see does not have Personalized Shopping.

Imagine if you lived in a country with a banking system so modern, that nobody needed Paypal or Venmo.

Oh, like the free bank transfers we’ve had in the UK since… 1997…?

Yes. What a lot of Americans don’t realise is that in other countries, bank account numbers are standardised to include pre-defined bank and branch information. In a sense, account number includes what americans think of as routing number.

People trade bank account numbers like business cards. Businesses post their account numbers for payment. Even a flyer for a local school fundraiser will have an account number listed on it. If you buy something from someone, the seller tells you his account number. You log into your bank and transfer the funds instantly, whether it’s $10 or $10000. You don’t need to know anything except the recipient’s account number.

It’s free. It’s painless. It’s interconnected. It’s bank agnostic. The movement of small monies between individuals should not be commoditised.

You don’t need to know anything except the recipient’s account number.

You need to know the name of the owner of the account. At least in my experience, if you put a wrong owner number the money transfer will be rejected.

Nope, you just need the IBAN, you can put any name you want, for your own reference

I even get a warning on my banking app saying to triple-check the IBAN because that’s the only thing the transfer is based on

Perhaps in your country. Not in mine. Number only no names.

No you don’t. The name field is optional. If your bank requires you to fill something in, their app/system hasn’t been updated to comply with EU banking regulations. I’d simply write Not Applicable from now on. Or Mickey Mouse.

US has been playing catch up for decades. FedNow was implemented in 2023 to allow instant P2P payments between banks thereby eliminating the need for PayPal, Cash App, Venmo, et al.

It will take some time before we see banks make this fully available to everyone and subsequently merchants using it.

Fednow for instant teansfers is based off PayPal tech.

Still need PayPal for some transactions that require a credit card. In the Netherlands, credit cards aren’t as commonplace as in the USA since we only pay with money we actually have.

I’m not saying I discredit your argument, I’m just angry at companies requiring either a credit card or PayPal (or even worse, those buy now pay later deals).

Same in Germany, so I just got a free credit card from Advanzia Bank in Luxembourg. As long as you pay the bill on the due date (via bank transfer, which is free in the EU), there are no fees and charges whatsoever.

deleted by creator

My wife has an ING credit card pretty much because you need one if you wanna rent a car abroad

I do imagine :(

Look up Pix in Brazil.

Uh, isn’t that normal? People use PayPal because of the easy of use resulting from its inherently low security that is still far better than CC, not because there aren’t sensible alternatives.

The sensible alternative is when banks allow instant free transfer of funds from your account to any other account regardless of which bank or recipient.

TIL that’s an 🇪🇺 thing that we already have that. 😅

Yeah, that’s illegal in the EU.

Hence it only applies in the US.

I only skim read, but the provided link seems to me that opting out isn’t an option:

However, if you would prefer to decline them, then you will need to close your PayPal account prior to the applicable effective date, as described in the user agreement.

Well, bye PayPal

Exactly. That’s how you opt out of this shitty practice.

A number of changes are being made at the same time, and only some of them can be opted-out of. This Lemmy post is focusing on one in particular that can.

Thanks for the heads up 👍

Here’s the direct link to disabling it but I assume Capcha or login will probably get in the way: https://www.paypal.com/myaccount/privacy/settings/recommendations

Thank you!

hey! I’ve seen you before!

I get around a lot.

Off-topic, but did you see Linkerbaan got baanned? LOL

I did. Hilarious.

And about damn time too.

Fucking legend. Thanks for the direct link and for (unintentionally) reminding me that it was time to change my PayPal password!

MVP for direct link, thank you 🙏

In the Android app, open your profile, tap Data and Privacy, then Personalized Shopping, then toggle it off.

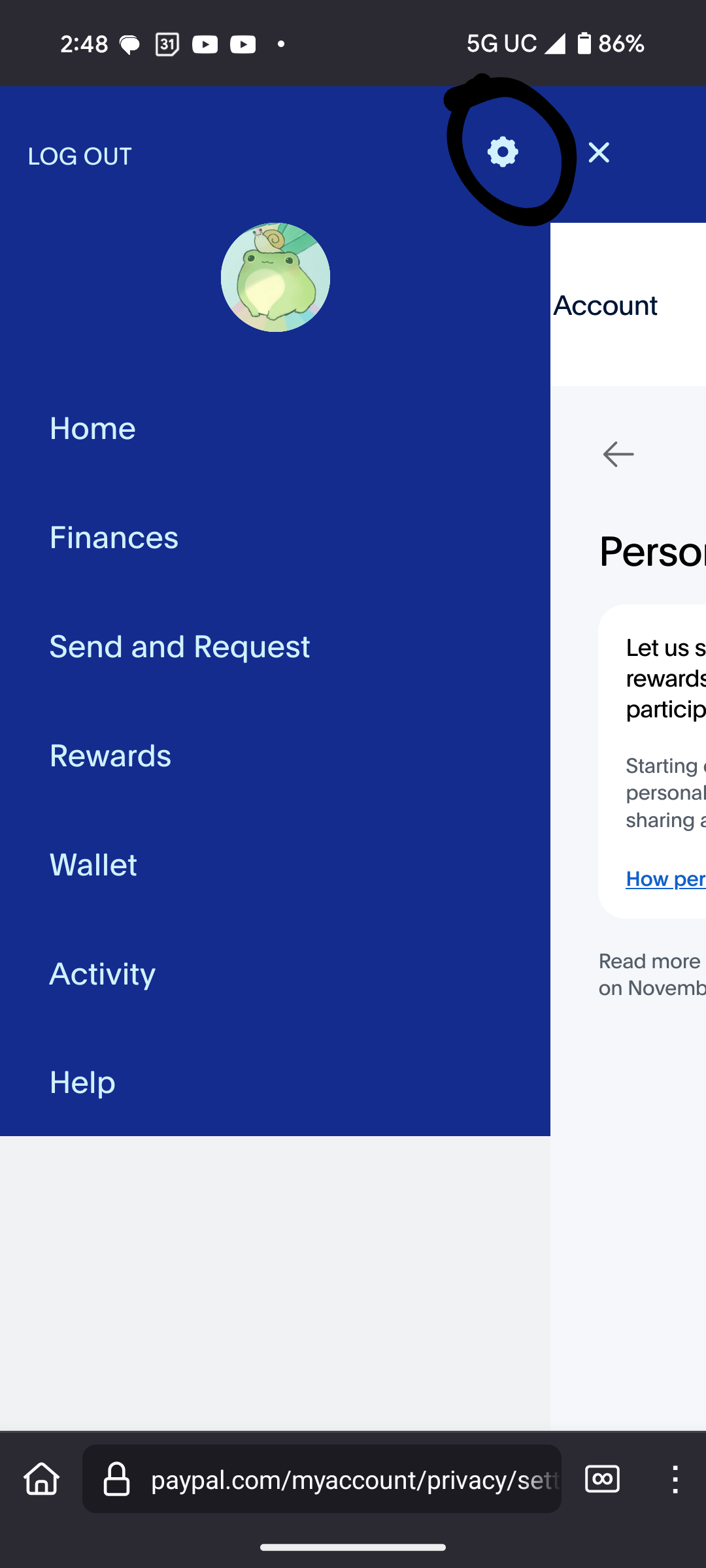

I’m just on Firefox mobile and had to do this,

1: log in

2: tap the hamburger then the settings icon

3: data and privacy then ‘personalized shopping’

It’s the same on the iOS app.

MVP

I Don’t Forget, I Don’t Forgive… https://www.forbes.com/sites/emilymason/2022/10/27/after-paypal-revokes-controversial-misinformation-policy-major-concerns-remain-over-2500-fine/

That was the moment I already deleted all PayPal accounts. To never return back.

Can’t read Forbes b/c of ad blocker.

Is it the fine or the redaction?

After facing backlash earlier this month, PayPal PYPL +1.9% rescinded a line in its policy stating that spreading misinformation on the platform would be subject to a $2,500 fine. Today, the remaining language leaves users and elected officials demanding more clarity over how the platform defines fine-worthy speech.

A part of PayPal’s user agreement that says any customer in violation of the platform’s “acceptable use” policy is subject to a $2,500 fine has been in place since at least 2013, according to the website’s archive. The fine had largely gone unnoticed until earlier this month when PayPal updated its acceptable use policy to state that messages which are “fraudulent, promote misinformation or are unlawful” are in violation of the policy and, by extension, subject to the fine. The “acceptable use” policy stated that determinations of which messages violated the policy would be made at “PayPal’s sole discretion.”

After drawing intense backlash from commentators stating that the policy could infringe upon free speech, the company rescinded the line in the policy citing misinformation and issued a statement saying it was posted in error on Monday, October 10. “PayPal is not fining people for misinformation and this language was never intended to be inserted in our policy,” a spokesperson for the company said. PayPal’s former president David Marcus was among dissenters, posting a tweet objecting to the policy update, which was amplified further when Elon Musk responded “Agreed.”

“PayPal’s new AUP goes against everything I believe in,” Marcus’ tweet reads. “A private company now gets to decide to take your money if you say something they disagree with. Insanity.”

The note about misinformation was removed from the acceptable use terms, but the $2,500 penalty for violations remains, causing continued concern.

PayPal’s website still lists “provide false, inaccurate or misleading information” under the “restricted activities” portion of its policy. Violating the “restricted activities” portion does not result automatically in the $2,500 fine that breaching the “acceptable use” agreement does, but it may still result in charges, account suspension or other punitive actions.

Unfortunately for PayPal, now that the $2,500 fine has landed in the public eye, it has fallen under close scrutiny. “Concerned about this language still in PayPal’s terms of service – it’s vague and seems like it could be weaponized to control speech,” Representative Tom Emmer (R - MN) wrote in a tweet on Thursday.

The ordeal has spurred a call for people to delete their PayPal accounts with #PayPalCancelled and #DeleteVenmo gaining momentum on Twitter. Where the policy finally lands may be especially relevant to PayPal’s Venmo, a peer-to-peer payments network with a social media feed where users share messages attached to their public transactions.

Sigh, yet another enshittified service to cancel.

As much as I support the notion. Some people, I’m thinking especially about international buyers and sellers, aren’t going to be able to do this. PayPal has too much of a monopoly on that front.

No doubt. All I can hope for is more tech companies get the kind of backlash Unity saw when they decided to screw everyone over.

Same reason lots of us moved here from Reddit.

Yup. I’ve had to stop using ebay because even when you check out with your own card, it goes via paypal, and they have misused my data too many times for me to keep putting any trust in them.

It sucks, because a lot of mutual aid is done over paypal too, but I’m really struggling to justify leaving my account open (and I’m not even in the US where op applies).

Lol, paypal now has an option to store your SSN and passport info. What a scam.

Account deleted.

https://www.paypal.com/myaccount/privacy/ -> Delete your data / close account

Oof. Thanks. I deleted mine as well. Never really use it anyway because I was always afraid of what they might do with my money.

Thank you. Just closed my account. Didn’t need it anyway and I sure as fuck don’t need to be generating income for PayPal anymore.

US only

Incorrect. It’s in my UK PayPal account settings too and I turned it off.

Thanks for the heads up, I would have missed that.

Venmo is owned by PayPal, but I couldn’t find any information about if similar Venmo TOS changes are planned or already in effect.

Whatever the parent company does tends to trickle down.

So Safe to always assume it does.

Checked my Venmo and there isn’t an opt-out yet.

I don’t know if that’s good or bad…

At least 3 states have common sense laws to auto opt-out. I think every state should have these privacy laws, even if those 3 are minimal at best.

Anyone know if this applies to Canada too? I looked but couldn’t find it.

US:

https://www.paypal.com/us/legalhub/privacy-full

Last updated on March 28, 2024

Canada:

https://www.paypal.com/ca/legalhub/privacy-full

Last updated on July 24, 2023

So I’d guess not.

But you might just want to keep an eye on that, because just because they haven’t changed it today doesn’t mean that they won’t later. Like, if their people are thinking that this is a good idea to make money in the US, they might also think that it’d be useful in Canada. Don’t know if Canada has any restrictions on such a change.

Page mentions “Notice of Amendment(s) to the United States PayPal Agreement(s)”. So it’s likely US only (for now).

If you don’t see the “Data and Privacy” option to opt out on their website or app. Then it’s likely they are not sharing your data, yet.