I’m an American sick of being taxed by the dysfunctional US federal government and am looking for ways to reduce the amount paid as well as increase my contribution to society. I’m not looking to reduce state taxes.

How can I find out the amount I can donate to charities each year such that it reduces my federal taxes as much as possible for my income level?

Tax write offs don’t really work the way people think they do. You reduce your taxable income by the amount you donate but you don’t pay 100% of your taxable income to the government.

So charity is like an inverted tax where you lose 80% of your money instead of the 20% you pay to the government.

Rich people make can make it work sometimes by donating assets that have an inflated value and otherwise don’t translate well to “income”.

Businesses operate very differently because they’re taxed on profits not income. So when you hear about businesses not paying taxes it is because they’ve cooked the books to have less “profit”.

Yep, you are spending $1 to save yourself ~$0.45

In most cases with rich people the two hacks are

-

Spending the money in the form of value indeterminate goods like artwork where you donate a painting you bought for 20k to a museum and the museum says “Gosh we probably would have paid 40 million for this painting” so for 20k you write off a 40 million loss. This is fraud if obvious but if the painting was last commercially sold in 1907 it’s really difficult to definitively say what it would sell for today and everyone involved is motivated to inflate that number as high as possible.

-

Donating to the “Me Benevolent Trust Foundation” Trump is famous for this bullshit but most billionaires do this. You donate your money to a charity that spends your money how you want it spent - maybe it’s somewhat altruistic and you’re just using it to invest in causes you care about while being able to write all your funding off as a loss for taxes or maybe the foundation operates a private jet that is exclusively used by you and charges you one dollar per flight. Trump has heavily abused these sorts of charities in the past.

Also like… other ways. Rich people go to extreme lengths to avoid paying taxes and some of those methods are truly bizarre.

But hey, as long as they all donate 1 million to his inauguration fund, Trump doesn’t give a shit.

To elaborate on #1: The museum then lends you the painting for the rest of your life.

-

Sort of; I object only to the way you presented it, not the facts.

You’re donating to a cause, which I assume you believe in, which reduces the value used to calculate your taxes. If you make $10, and you donate $1 to a charity, you get taxed as if you made $9. This applies to all income taxes, since state taxes are based largely on your taxable federal income. So OP could try to do something like do their fed taxes and instead of copying “$9” put "$10” where their state forms say to use the federal value, but that’s likely to raise a flag somewhere.

My main issue is the portrayal that donations are “spending money.” You could probably successfully argue that “donating” satisfies the definition of “spending money”, but that does a disservice to charity.

Also, just as an aside, OP would never save $0.45 on a dollar donation. No income tax bracket is that high except for the very rich, and they have many other ways to avoid paying taxes that in no way benefit charities.

I agree it is a bit reductionist but when people say ‘give money to charity because you can claim it off your taxes’ that is also reductionism.

Sure. I mean, it’s doing the right thing for the wrong reason, but you do reduce the taxes you pay by contributing to charities.

The standard deduction is $14,600 for FY 2024 ($15,000 for FY 2025)

So you would have to itemize your deductions and donate at least the difference between $14,600 and the itemized deduction total to “break even” if you were to not take the standard deduction. And then donate above that amount to reduce the taxable amount.

One scummy way would be to have an artist friend paint you something. If you can get that painting appraised at a crazy high value and donate it to a valid charity, you can deduct it at the appraised value (I think, anyway.)

One scummy way would be to have an artist friend paint you something. If you can get that painting appraised at a crazy high value and donate it to a valid charity, you can deduct it at the appraised value (I think, anyway.)

I would highly recommend against attempting tax fraud. The IRS does not appreciate it.

Yeah, 100%. But, AFAIK, that’s how “art” works. Though you definitely want to make sure the appraiser is legitimate; can’t just have another buddy say it’s worth $12 million and write it off as such.

Max out your pre-tax investments. 401k, HSA, 529, IRA, …

If you itemize deductions, whatever you donate will reduce your taxable income by the same amount. So, if you have $50,000 in taxable income and donate $1,000, that will now become $49,000 in taxable income instead.

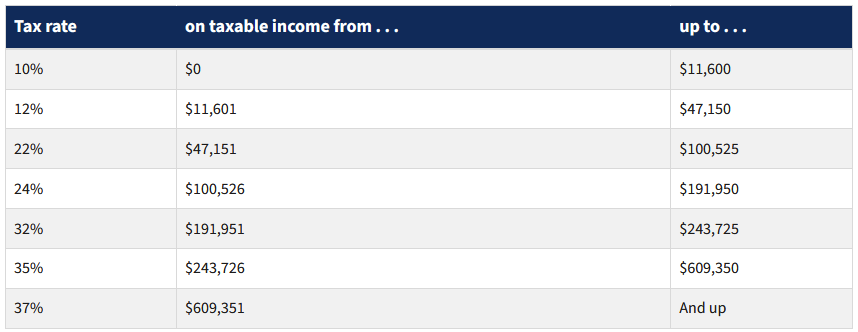

The 2024 tax rates for a single (not married filing jointly) individual are below. In this case, that deduction would come completely out of the 22% bracket, ie, your $1,000 in donations will reduce your tax burden by $220.

Keep in mind the standard deduction for a single individual is $14,600. You can take this instead of itemizing deductions as described above, and it works the same as if you had itemized deductions up to that value. If you have deductions less than that value, take the standard deduction; if they are greater, itemize deductions. The standard deduction for married filing jointly is $29,200.

Do note, this only covers federal taxes, your state taxes may work differently.

Doing research I think I’ve got my head around it. I’ll probably talk to a tax accountant regardless, but this information seems to be correct.

Talk to a tax accountant.

I wish I could not fund military spending, otherwise taxes are good.

yeah im not so sure making charitable contributions tax deductible is a good thing honestly.