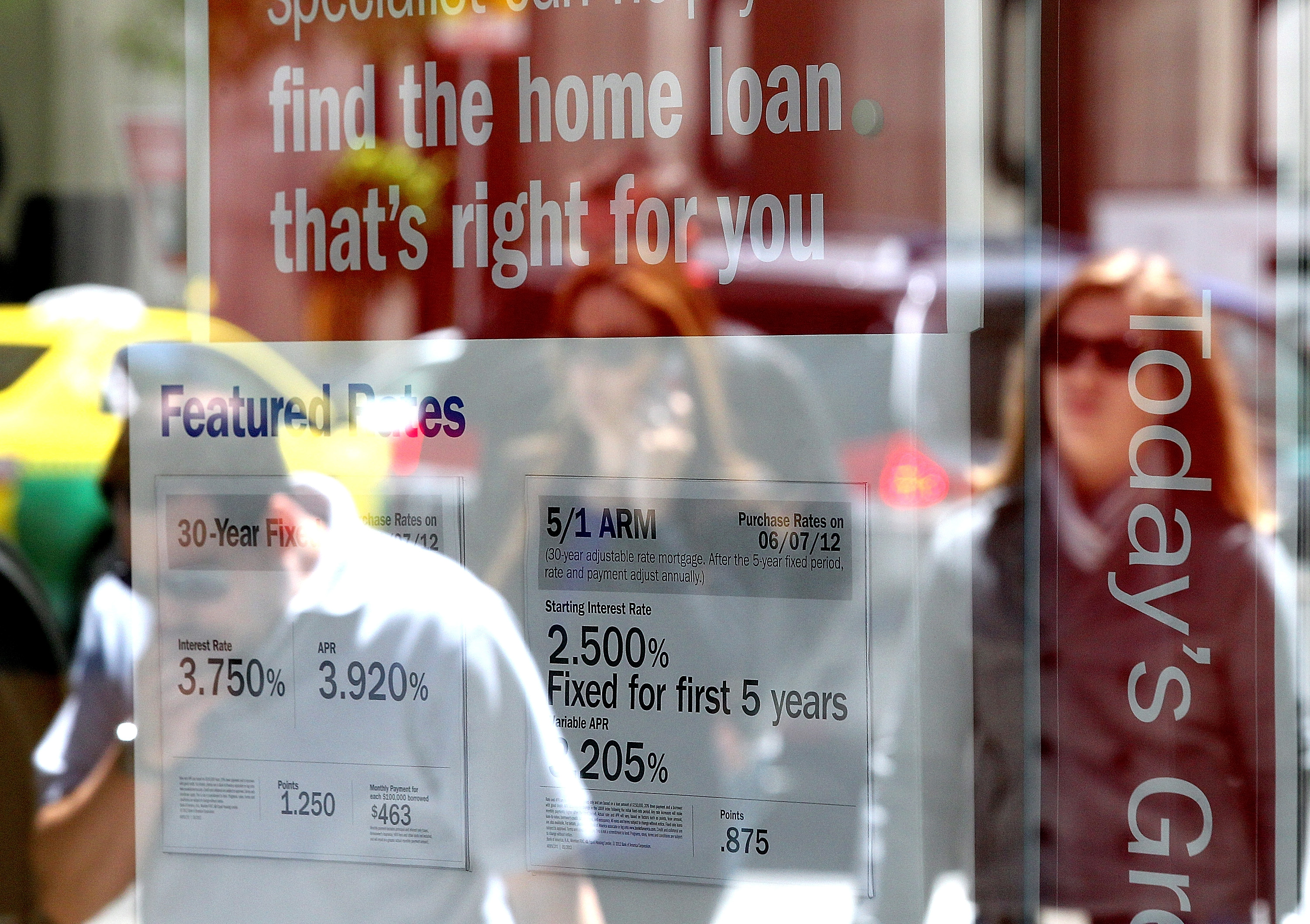

Housing economists are urging the Federal Reserve to hold back on raising rates, worried that elevated borrowing costs—that have gone up since the central bank began its hiking cycle in March 2022—have pushed mortgage rates too high and made homes unaffordable for many Americans.

Sales of homes dropped 2 percent in September to a little under 4 million, the lowest such level for more than a decade. The decline, which was a 15 percent plunge compared to a year ago, according to the National Association of Realtors (NAR), was the latest evidence that expensive mortgages are dissuading potential buyers from purchasing homes.

You’re talking about hyper inflation basically? Did you enjoy the grocery prices just skyrocketing during covid without your salary keeping up? Imagine that on everything.

Grocery price increases have been more gouging than inflation, but generally I agree.